Introduction

Climate risk is financial risk, and the impact of climate change on mortgage markets is a particular area of growing concern. Emerging research shows that this is no longer a distant specter but an evolving reality already shaping US credit markets. For example, a study of 6.7 million borrowers by the Federal Reserve Bank of Dallas found that higher climate-driven insurance premiums significantly increased the probability of mortgage delinquency, while another by ICE concluded that homes in high physical-climate-risk areas exhibit elevated delinquency rates even after controlling for other factors.

AlphaGeo’s own research, analyzing mortgage delinquency data between 2015 and 2023 across nearly 500 U.S. counties, found that climate and insurance variables were significantly correlated with default rates, alongside traditional socioeconomic drivers such as unemployment and income.

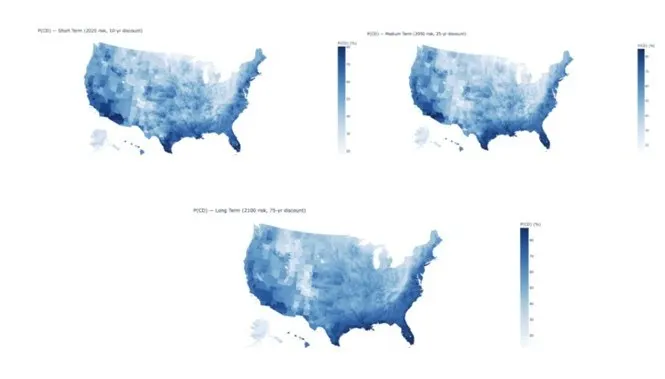

AlphaGeo’s Probability of Climate Default Index

This emergent backdrop is why AlphaGeo is launching our new Probability of Climate Default (P(CD)) index — a first-of-its-kind metric that quantifies, scores, and indexes U.S. locations based on how climate change and rising insurance premiums are likely to affect mortgage default risk.

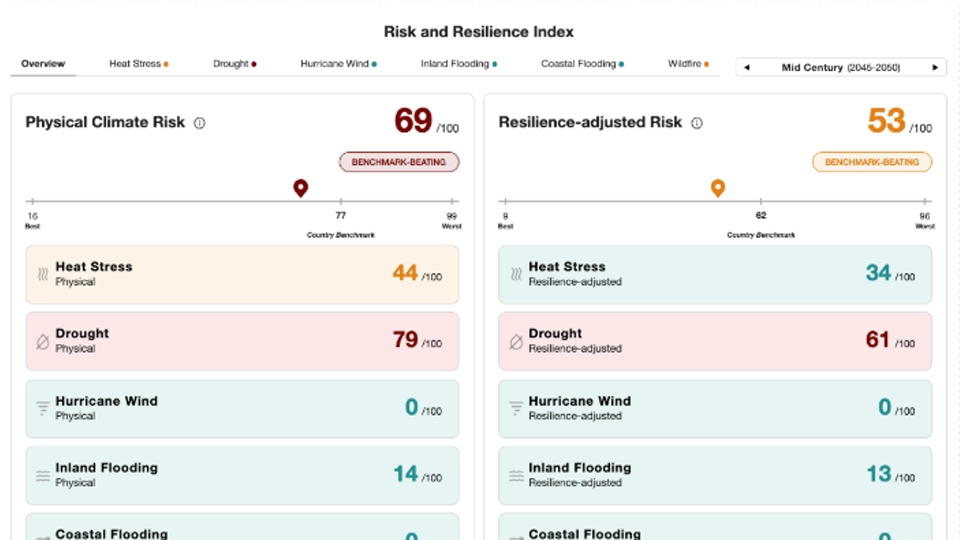

Unlike conventional probability-of-default (P(D)) models, which focus on historical borrower or loan behaviour, P(CD) embeds forward-looking adjustments and external stressors to capture climate-adjusted credit risk. The index measures each location’s relative susceptibility of mortgage performance to climate and insurance stressors on a 0–100 scale, combining the influence of:

- Climate exposures;

- Insurance premium adjustments; and

- Local economic conditions across multiple climate scenarios and time horizons.

Key Insights

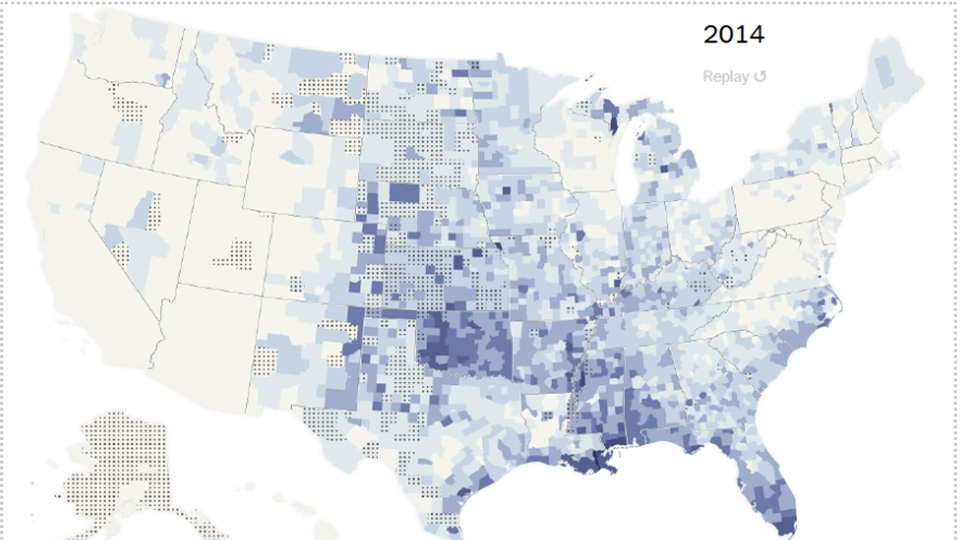

Our county-level forecasts reveal interesting patterns:

- Current (2025): Climate-adjusted risk remains modest and geographically concentrated, with higher P(CD) values in coastal, southern, and high-insurance-premium counties.

- Medium-term (2050): Broader diffusion of impact, particularly across the Gulf Coast (Texas, Louisiana, Mississippi, Alabama, and Florida) and inland regions, where increased climate risk and housing unaffordability elevates this stress. By 2050, more counties transition into elevated P(CD) categories, signaling intensifying structural risk.

- Long-term (2100): Large clusters of high-risk counties now appear along both coasts and throughout parts of the South and West.

Implications for Key Stakeholders

By bridging credit analytics with climate science, AlphaGeo’s new P(CD) index reveals how climate and insurance pressures are reshaping the financial foundings of U.S. housing markets.

For banks and mortgage lenders, P(CD) provides a climate-adjusted lens for underwriting, portfolio stress testing, and collateral valuation, helping to quantify and manage emerging credit risks in exposed regions.

For investors, P(CD) provides a quantitative signal of climate-adjusted mortgage exposure, enabling more informed portfolio construction and regional asset-allocation decisions.

For policymakers and regulators, it highlights where environmental exposure and economic fragility could converge, guiding adaptation funding and climate-resilient housing policies to safeguard the financial stability of US mortgage markets.

Learn More

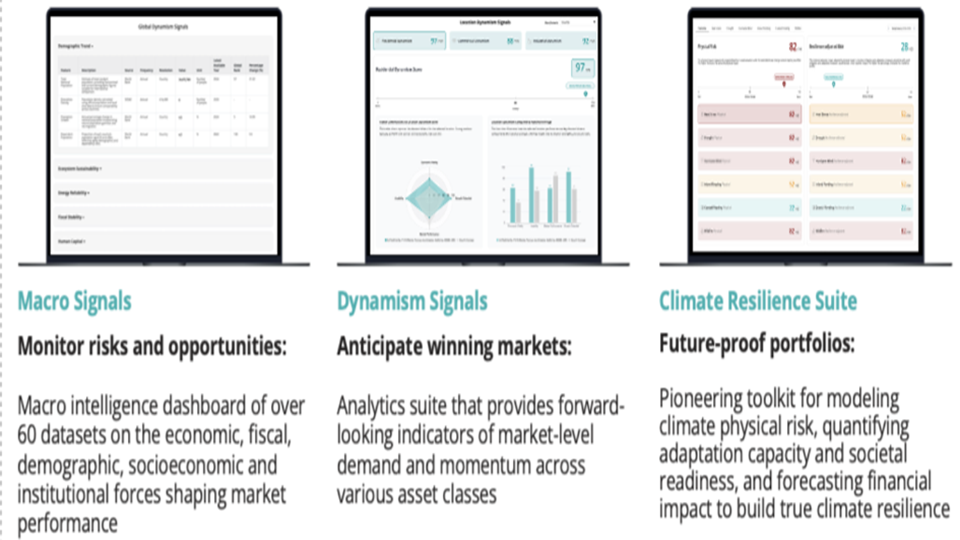

Our Probability of Climate Default forecast is available as part of the Location Dynamism Signals product suite, a market research toolkit helping investors identify climate-resilient and high-potential markets with confidence. It is also available to be purchased as a standalone dataset, via our Global Data Marketplace.

Those interested in learning more about the Probability of Climate Default (P(CD)) Index, its methodology, or seeing a live demonstration can connect with us through the following channels:

Reach out: [email protected]

Book a demo: Schedule here

Free trial: https://app.alphageo.ai/trial_setup