Risk, adaptation and resilience

Our unique methodology models risk, quantifies adaptation gaps, calculates financial impact and measures overall resilience.

From defense to offense

From risk management and reporting to due diligence and market analysis, our clients avert losses and gain first-mover advantage.

Explainable and actionable

Our rigorous and verifiable analytics are intuitive for all stakeholders and translate into confident investment recommendations.

Transparent and compliant

Peer-reviewed data sources and open-source methodology compliant with global regulatory standards and delivered on a fully secure platform.

Proprietary Analytics

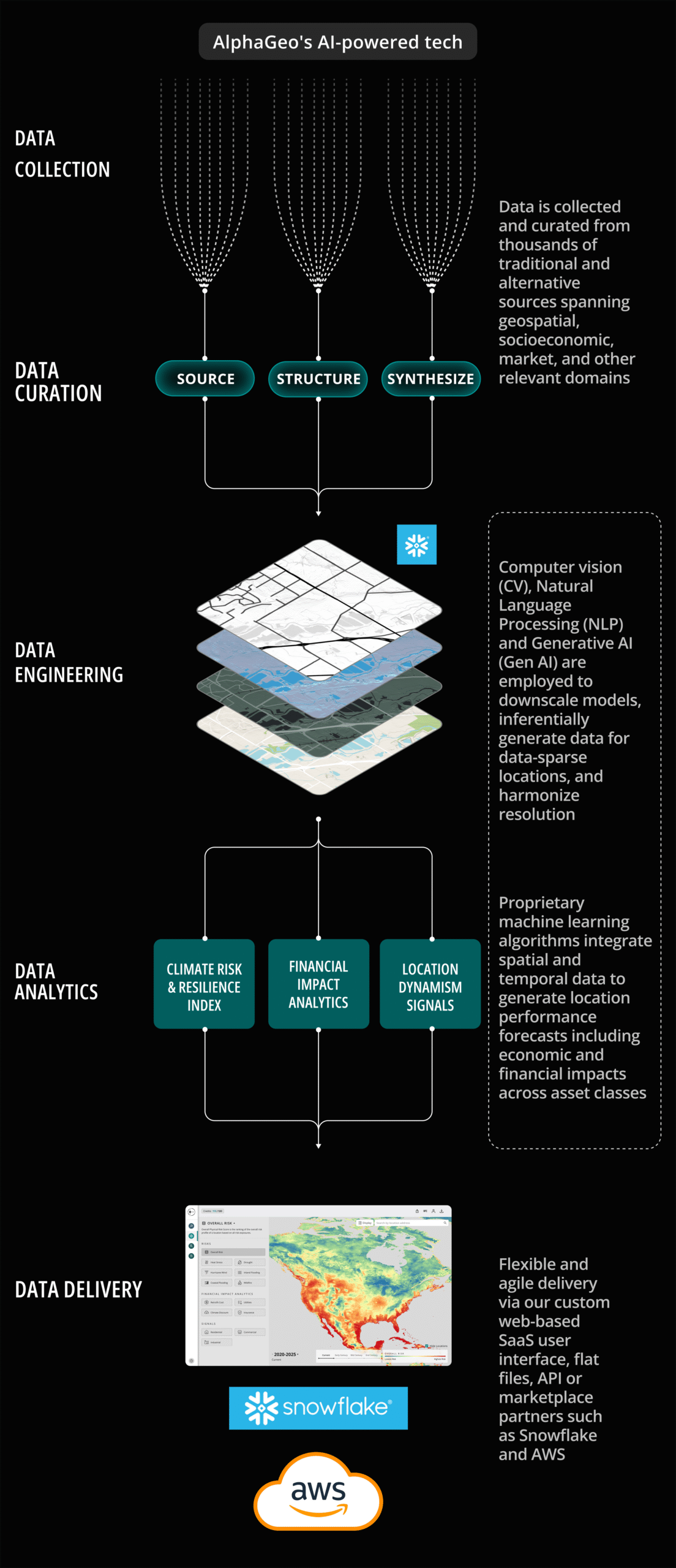

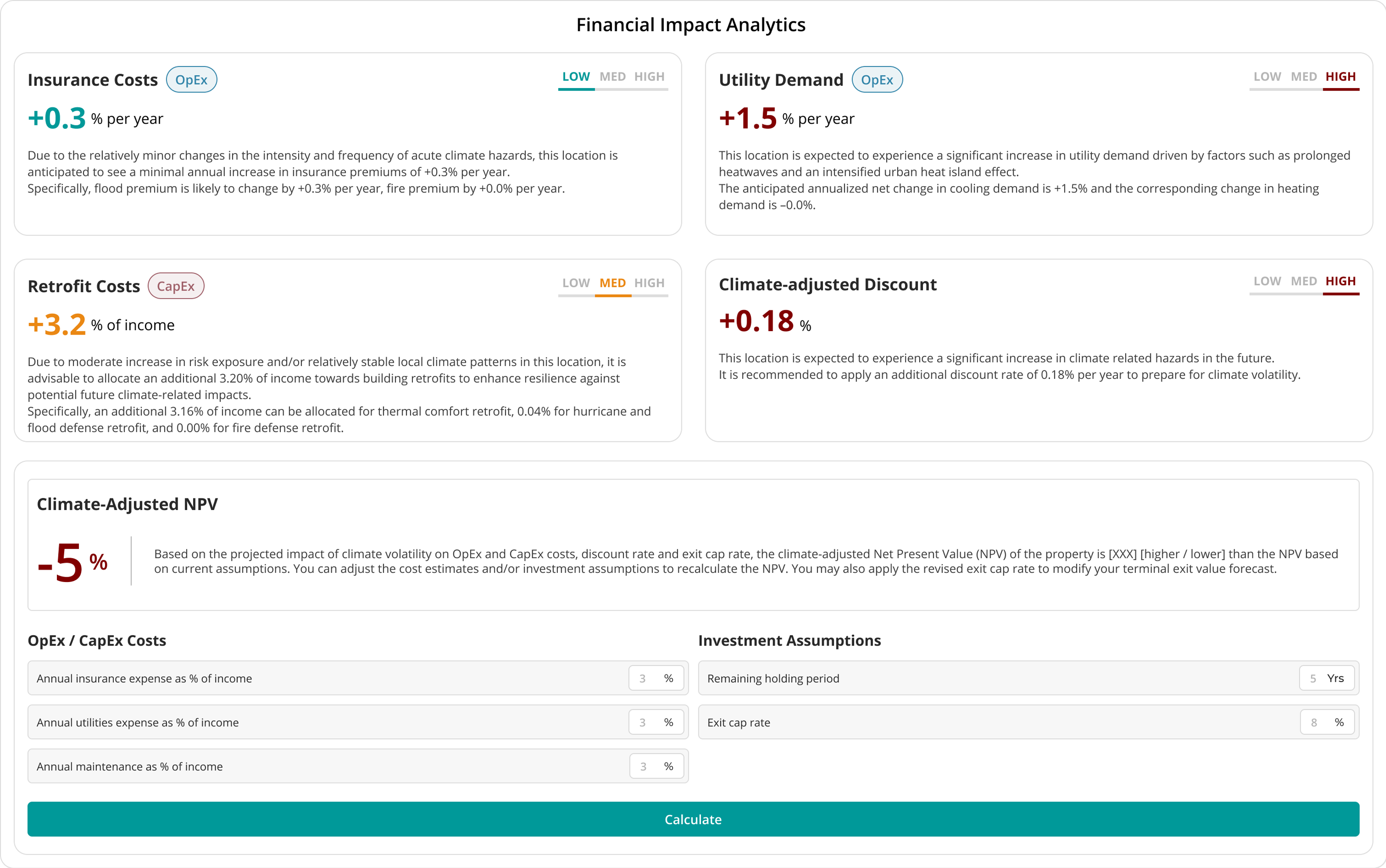

Advanced analytics that transform data into insights for confident decision-making

Strategic Services

Bespoke advisory for investors, corporates, and governments to guide strategic planning

Assess and Adapt

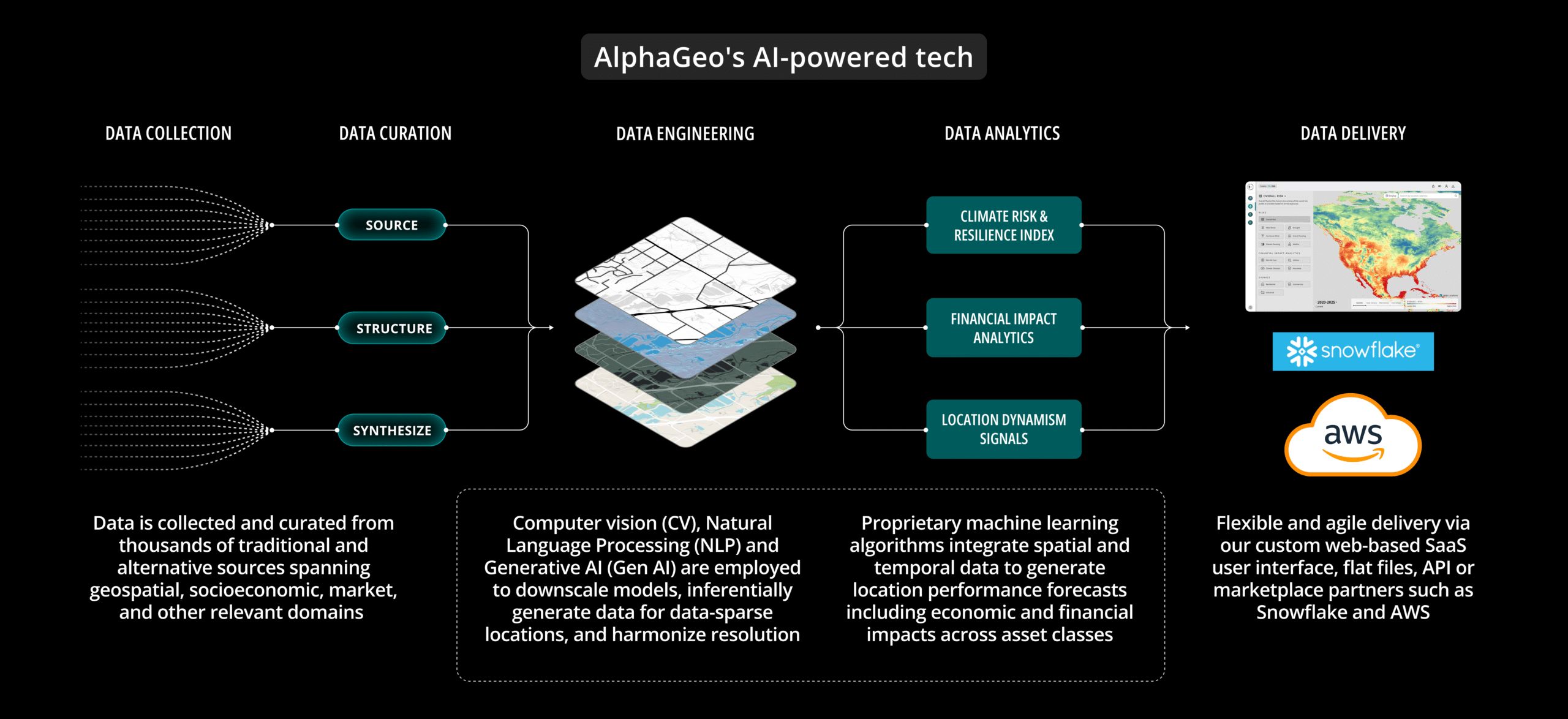

Quantify physical climate risk and adaptation capacity – scoring asset and portfolio resilience at global scale.

Measure Your True Risk – And Adapt

The Climate Risk and Resilience Index is the first solution to integrate physical risk with on-the-ground adaptation and resilience data, delivering more accurate Resilience-adjusted Risk scores and Adaptation Data to guide smarter adaptation and divestment decisions – preventing misallocated resources and missed opportunities.

Model Impact

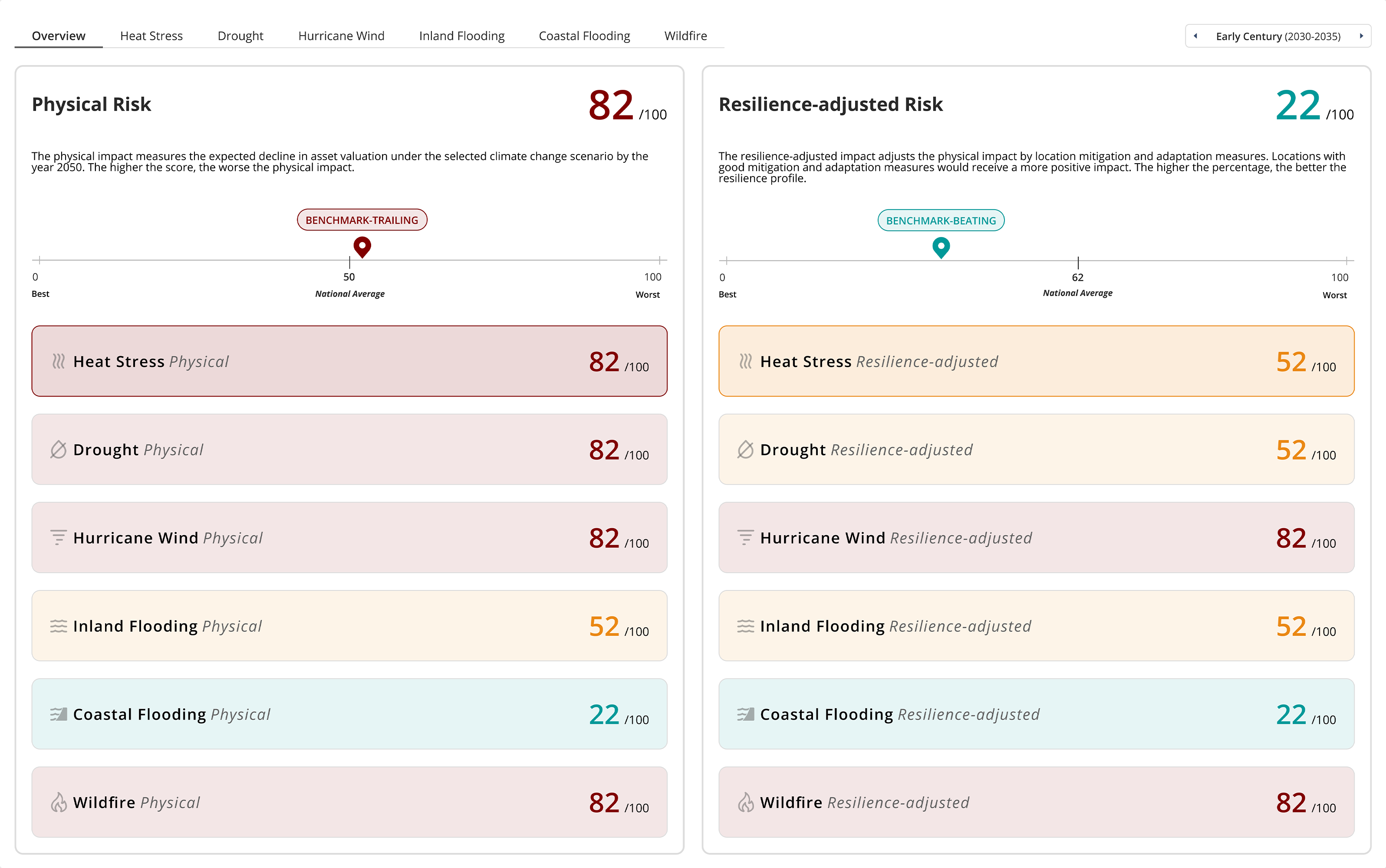

Forecast impact of climate scenarios on Revenues, OpEx, and CapEx for more accurate investment and financial analyses.

Model Detailed Cashflow Impact

Climate financial impact metrics that focus only on losses or asset damage are useful for risk assessments but insufficient for asset-level financial analysis. Our bottom-up approach models climate impacts on cashflow drivers, like insurance costs or utility demand, for integration into robust financial models.

Identify Opportunity

Target markets with high growth potential for acquisitions and investments.

From Risk to Opportunity

Signals is a market research tool that integrates real estate, investment, socioeconomic and climate variables into location dynamism scores and location performance forecasts. Complementing our risk data that highlights areas to avoid, Signals guides investors toward zones of opportunity characterized by high resilience and growth potential.

Rebalance portfolios with our robust financial impact metrics

Boost returns by investing in high-performing assets

AlphaGeo Explorer is an interactive platform for enterprise-scale data visualization and analysis, scenario modelling, as well as automated report generation and sharing

From climate risk and adaptation to macroeconomic, demographic, real estate, and socioeconomic indicators, our Global Data Marketplace delivers actionable analytics.

Location Strategies

Acquisition Advisory

We leverage proprietary analytics and tools to help clients identify resilient locations that align with their strategies.

Investment Strategies

Investment Advisory

We develop tracking indices for market benchmarks, and support clients in constructing resilient portfolios across public equities, private fund investments and real assets.

Resilience Strategies

Government Advisory

We collaborate with governments at all levels—federal, provincial, and municipal — on adaptation masterplans, resilience certification, investment promotion, and place-branding initiatives.

Oaktree, a leader among global investment managers specializing in alternative investments, wanted to quantify its exposure to physical climate risk underneath its complex composition of real estate equity, private loans and traded securities. AlphaGeo worked closely with the firm to pinpoint climate risk, attribute it by fund, and calculate its potential impact over time. In analyzing the financial impact of climate volatility on its portfolios, Oaktree was able to rank and compare its asset performance across existing – and future – investments.

Stoneweg US, a leading real estate firm focused on sustainable multifamily assets, used AlphaGeo to strengthen the credibility and utility of their ESG management and reporting. With AlphaGeo’s analytics, Stoneweg was able to produce a detailed, TCFD-aligned climate risk disclosure that speaks to both physical climate risk, as well as its implications for long-term portfolio resilience. This is enabled by AlphaGeo’s unique resilience-adjusted approach to risk, and financial impact analytics that model critical drivers of real estate cashflows. Stoneweg also leverages AlphaGeo’s Multifamily Benchmark to contextualize results relative to sector peers.

Atlas Capital was mandated to build a systematic investment index comprising multiple asset classes including REITs. AlphaGeo integrated multiple data streams from institutional vendors and provided risk-adjusted valuation for more than 150,000 REIT properties under multiple climate scenarios. This analysis was delivered on a custom interactive dashboard that ranks and clusters REITs according to location, property type, and other metrics, with quarterly updates based on the latest market data, allowing for algorithmic management of the Atlas Sustainable REIT Index.

One of the largest Gulf sovereign wealth funds with a substantial global portfolio of infrastructure assets leveraged AlphaGeo’s platform to conduct a rigorous analysis of the medium term exposure to climate risk of its largest direct investments, including very large distributed infrastructures such as gas pipelines, railways and transmission grids. Sharing AlphaGeo’s data with relevant operating companies, it encouraged them to undertake more rigorous risk mitigation and local adaptation measures.

MARA (Nasdaq: MARA), the world leader in leveraging digital asset compute to support energy transformation, retained AlphaGeo to provide detailed data on the physical climate risk and adaptation attributes for every location of its data centers and other facilities, and leveraged its machine-learning models to forecast their energy costs and insurance premiums. AlphaGeo further offers its expertise to MARA and its financial partners and host governments to assess national energy supply and demand dynamics, address specific concerns such as water risk, and calculate power generation potential from existing and planned grid investments as well as renewable sources.

Green Street, a leader in commercial real estate research and data, sought advanced analytics on the financial impact of climate risk as it expands its market coverage to Canada and Europe. AlphaGeo provided its proprietary location risk and adaptation scores aggregated and harmonized to the diverse spatial resolutions standard across various countries. This data was embedded into Green Street’s Market Data product, and will help real estate investors price climate risk into their capital allocation strategies over multiple time horizons.

Winner of the Zurich Insurance Group Sustainability Challenge

Winner of the G42 Presight

AI Accelerator

To provide the best experience, we use technologies like cookies to store and/or access device information. Not consenting or withdrawing consent may adversely affect certain features and functions. Please read our Legal Items and Disclosures for more information.

To provide the best experience, we use technologies like cookies to store and/or access device information. Not consenting or withdrawing consent may adversely affect certain features and functions. Please read our Legal Items and Disclosures for more information.