AlphaGeo Insights

Where Should You Put Your Next Data Center?

Data center investment is accelerating, but location risk is compounding. Climate exposure, grid stress, land competition, and infrastructure concentration are reshaping the economics of

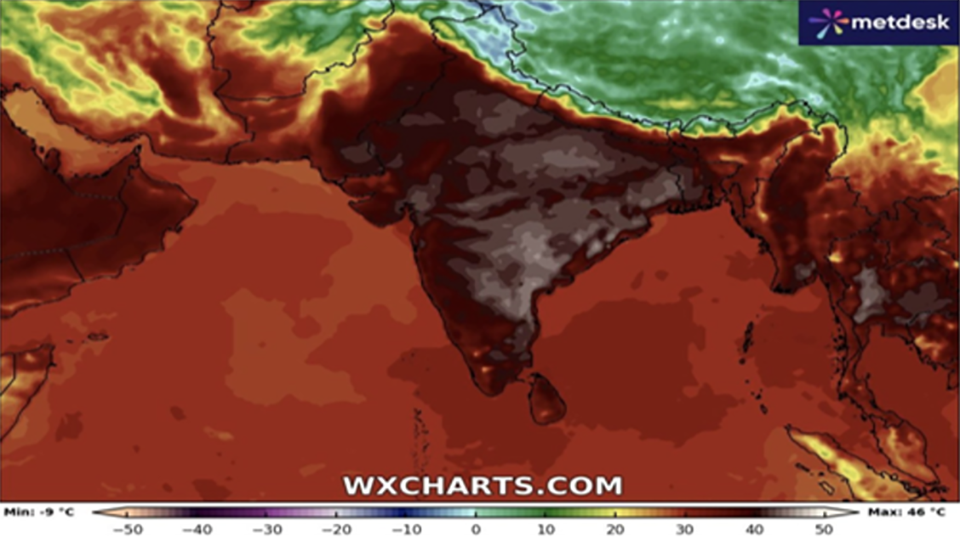

India’s Climate Reckoning: The Case for Urgent Adaptation

India may remain the world’s fastest-growing large economy — but only if climate adaptation becomes a strategic priority. AlphaGeo’s bottom-up recalibration of state-level GDP

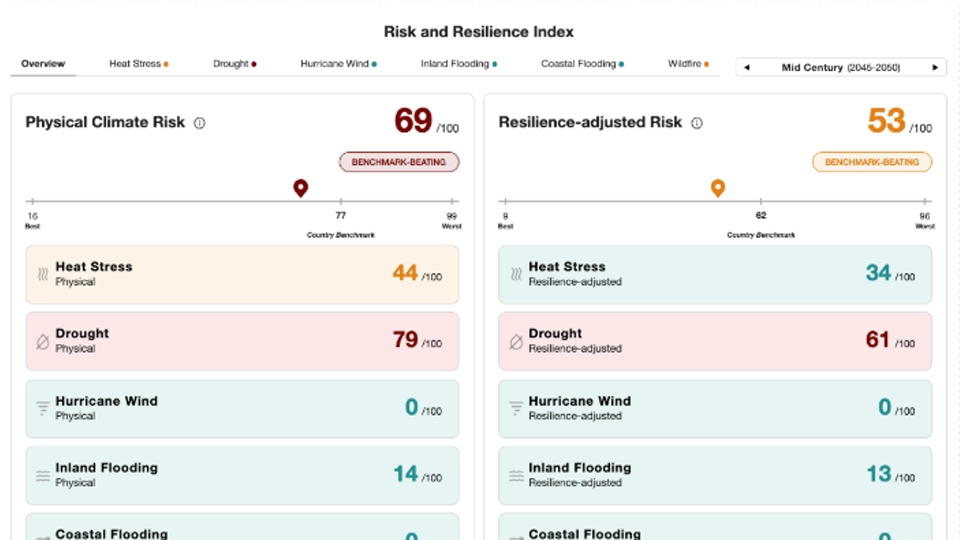

Beyond Hazard Maps: The Case for Resilience-Adjusted Risk

Physical hazard scores show what could happen — but not what is likely to happen. Resilience-adjusted risk integrates adaptation infrastructure and societal capacity directly

Where next for digital nomads? AlphaGeo has you covered

Where will the world’s most mobile communities settle next? Digital nomads and pop-up city builders are shifting from lifestyle choices to strategic location decisions,

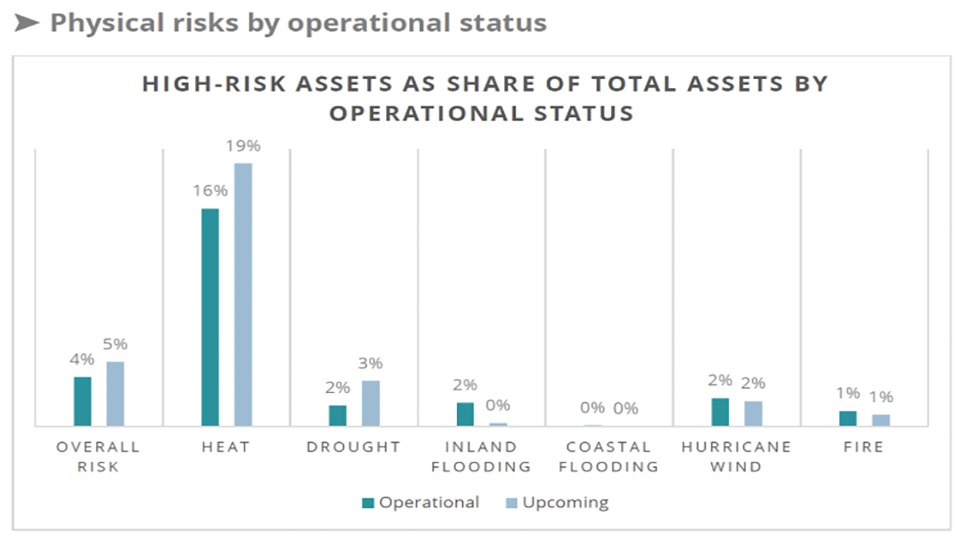

AlphaGeo for Asset Owners: Future-Proofing Real Asset Portfolios

As climate volatility, structural demand shifts, and geopolitical realignment reshape the value of place, asset owners must rethink how they assess risk and opportunity.

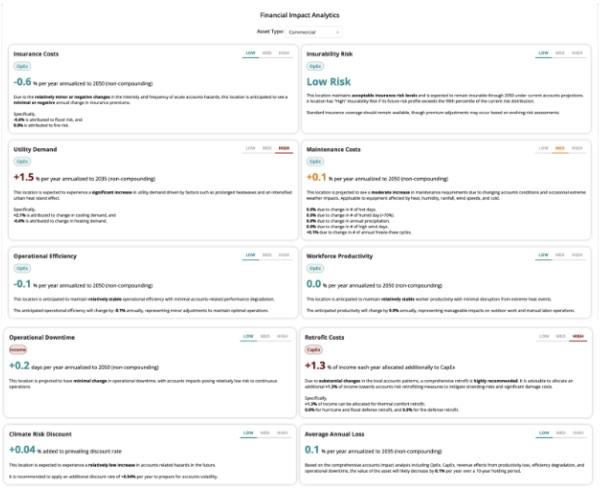

Beyond VaR: Underwrite Climate Risk with Climate-Adjusted NPV

Traditional Climate VaR offers top-down risk reporting, but misses the cashflow-level impacts investors need. AlphaGeo’s Financial Impact Analytics translate climate threats into asset-specific operational

Why Investors Are Turning to AlphaGeo for Adaptation Alpha

Climate adaptation is no longer a policy footnote but a core investment question. While national scorecards signal intent, investors need asset-level evidence of resilience.

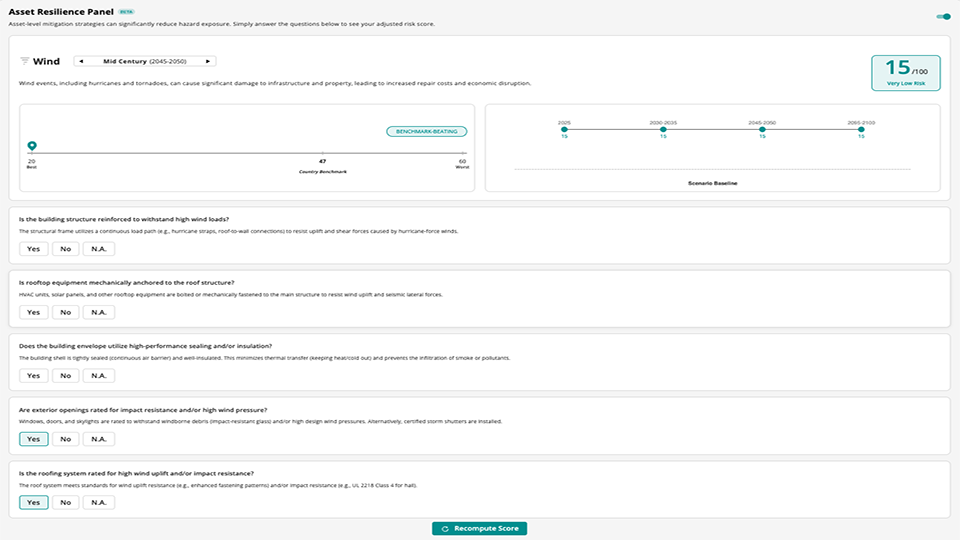

Introducing AlphaGeo’s Asset Resilience Panel: From Climate Risk to Climate Adaptation

Climate risk isn’t just about where assets sit—it’s about how they’re built. AlphaGeo’s Asset Resilience Checklist reveals how real-world adaptation measures change risk, ROI,

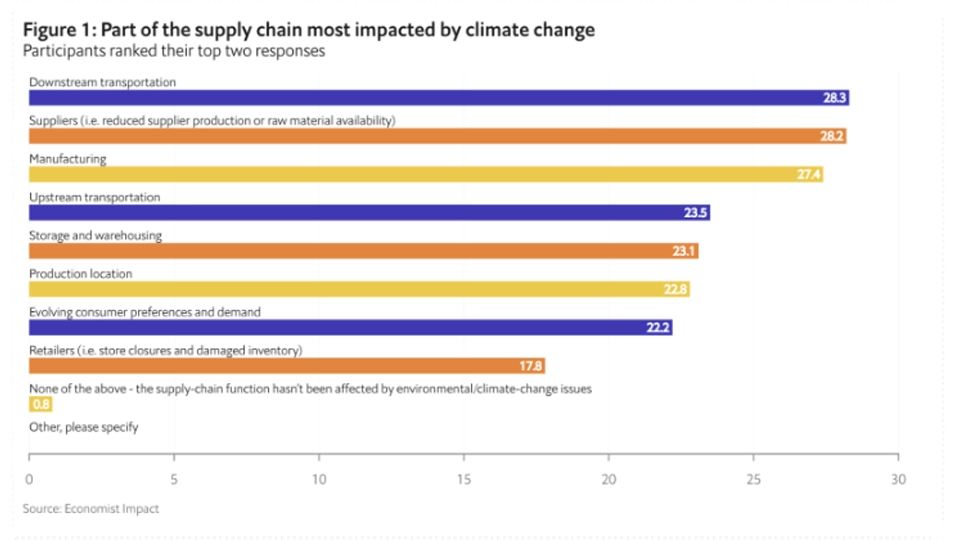

A New Bottleneck: Climate Volatility as Systemic Supply Chain Risk

Global supply chains, once built for pure efficiency, are increasingly strained by climate volatility. From drought-restricted canals to extreme weather disrupting critical suppliers, climate

From Data to Decisions: Actionable Climate Adaptation Solutions with AlphaGeo and Snowflake Intelligence

Climate volatility has shifted from a distant concern to an immediate risk for global investors and corporations. AlphaGeo and Snowflake are bridging the gap