Climate risk quantification is now central to real asset investment. Yet, the dominant Climate Value-at-Risk (VaR) approach is increasingly inadequate for asset managers who need actionable insights—not just risk reporting. AlphaGeo’s cashflow-driven Financial Impact Analytics (FIA) offer a more strategic alternative, integrating climate impacts directly into valuation models.

VaR vs. NPV: Risk Reporting vs. Strategic Finance

Climate VaR adapts the traditional Value-at-Risk methodology—originally developed for portfolio risk management in banking and securities firms—to estimate potential losses as a percentage of asset value under climate scenarios. For a commercial property facing flood risk, Climate VaR analysis might showpotential valuation impacts of 2.3-4.0% under 2°C scenarios across global real estate portfolios. This metric is useful for stress testing and regulatory compliance, but it provides only a top-down, aggregate view of risk.

In contrast, climate-informed NPV analysis (or other forms of cashflow-driven financial analysis, for that matter) models how climate change affects specific cashflow drivers: operating expenses (insurance, utilities), capital expenditures (retrofits), revenue disruptions, and risk-adjusted discount rates. These climate-adjusted assumptions feed into discounted cashflow (DCF) models to recalculate net present value under various scenarios. While VaR answers “How much value might we lose?”, NPV answers “How should we adjust our underwriting, holding period returns, and exit assumptions?”.

Limitations of Climate VaR for Investment Decisions

Climate VaR has 3 main limitations for real asset investors:

Lack of granularity. VaR expresses climate impact as a percentage of asset value, obscuring the specific mechanisms of risk. For example, 2 properties facing different climate challenges—rising insurance costs vs. major retrofit needs—might have the same VaR, but require entirely different investment strategies.

Unrealistic assumptions. VaR typically assumes climate costs are not yet priced into valuations. In reality, sophisticated buyers already factor climate risk into pricing, so VaR estimates can mislead actual investment decisions.

Compatability with financial decision-making frameworks. VaR is ideal for risk management and compliance but does not integrate well into typical financial modelling frameworks, and offers little guidance for strategic capital allocation.

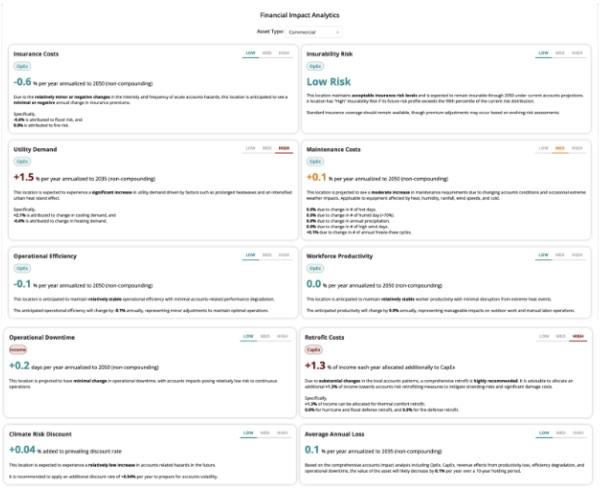

AlphaGeo’s FIA: Translating Climate Risk into Cashflow Impact

AlphaGeo’s Financial Impact Analytics (FIA) address these gaps with a bottom-up approach that decomposes climate risk into specific financial drivers.

- Insurance cost. Forecasted change in insurance premiums driven by forecasted trends in flood or fire premiums.

- Insurability risk. Forecasts the risk of a location becoming technically or economically uninsurable.

- Utility demand. Change in utility demand driven by shifts in heating and cooling demand.

- Maintenance cost. Forecasted change in the costs of upkeep and repairs caused by changing chronic climate conditions and acute extreme weather events.

- Operational efficiency. Annual rate of change in operational efficiency due to temperature effects on HVAC systems and equipment performance.

- Workforce productivity. Forecasted change in workforce productivity driven by extreme heat.

- Operational downtime. Annual change in operational downtime due to risks of precipitation, fire, and water shortage to continuous operations.

- Retrofit costs. Additional CapEx for thermal comfort and hazard reinforcement retrofits.

- Climate rate discount. Climate-adjusted discount rate/exit cap rate.

- Revenue impact. Projects annual revenue changes from combined operational downtime, efficiency losses, and productivity impacts.

These inputs integrate seamlessly into DCF models, generating climate-adjusted NPV estimates under multiple scenarios.

Asset-Specific Calibration Across Real Assets

AlphaGeo’s FIA are calibrated for 9 distinct asset types spanning real estate, infrastructure, and land: Residential, Commercial, Power Plants, Electricity Transmission & Distribution, Water & Wastewater, Transport (Road & Rail), Airports, Seaports, and Data Centers. This asset-specific calibration ensures that financial impact estimates reflect the unique operational characteristics, capital intensity, and climate vulnerabilities of each asset class.

The Strategic Imperative

Climate risk analysis must evolve from a compliance exercise to a competitive advantage. For asset managers, this means moving from aggregate loss estimates to granular cashflow modeling that informs every stage of the investment lifecycle—from underwriting to asset management and disposition. The question is no longer whether to integrate climate into real asset valuation—but how deeply.

Learn More

Interested in learning more about our approach to climate-informed financial modelling? Explore our Climate Finance 101 series: