case study

Stoneweg US Drives Value through Climate Resilience with AlphaGeo

Overview

Stoneweg US (“Stoneweg”), a leading U.S. multifamily real estate investment manager, partnered with AlphaGeo to integrate physical climate risk and resilience into its operations. Leveraging AlphaGeo’s accessible, actionable, and real estate-specific analytics, Stoneweg embedded climate considerations across its workflows — from risk management to acquisitions and asset management — elevating its approach well beyond basic ESG compliance.

“AlphaGeo is helping us move beyond climate risk awareness to real operational integration. Their platform delivers explainable data that’s easy to engage with across teams—from acquisitions to asset management—supporting resilience and adaptation in routine decision-making. It’s not just a reporting tool; it’s a strategic, forward-looking resource that empowers Stoneweg US to act on climate risk in ways that drive long-term investment value.”

Thomas Stanchak, Managing Director of Sustainability, Stoneweg US, LLC

Challenge

Stoneweg’s prior risk vendor left gaps for real estate workflows:

Stoneweg thus sought a provider offering accessible, real estate-relevant metrics that could drive organization-wide engagement with climate risk. The goal was to ease the burden on sustainability teams while ensuring that climate considerations advanced beyond compliance reporting to serve as a genuine strategic value driver.

Why AlphaGeo

After a thorough evaluation of multiple providers, Stoneweg selected AlphaGeo for its:

AlphaGeo’s user-friendly metrics and interface required minimal technical expertise, enabling real estate teams to work independently and reducing reliance on sustainability staff.

An unlimited-seat license ensured seamless, organization-wide access to the platform, enabling broad adoption.

Solution

Stoneweg adopted AlphaGeo’s Climate Risk and Resilience Index and Financial Impact Analytics through a SaaS subscription to the AlphaGeo Explorer platform, which provides portfolio- and asset-level data analysis, visualization, reporting, and on-demand report-sharing. Their unlimited-seat institutional account allowed administrators to grant access organization-wide. Onboarding on AlphaGeo’s web-based platform was completed within days.

Stoneweg utilized AlphaGeo’s analytics for:

Streamlined, TCFD-aligned ESG reporting: AlphaGeo’s intuitive, TCFD-aligned interface provided transparent metrics with clear explanations of models, scenarios, and time horizons, simplifying reporting and minimizing the need for interpretation by sustainability teams.

Portfolio and asset-level risk monitoring: Clear scores, visualizations, and reports enabled all stakeholders to understand and manage risks effectively.

Climate-informed due diligence and financial modeling: AlphaGeo’s granular, real estate-relevant Financial Impact Analytics (e.g., Insurance Cost Impact, Retrofit Cost Impact) helped Stoneweg easily integrate climate considerations into acquisition underwriting and financial modelling.

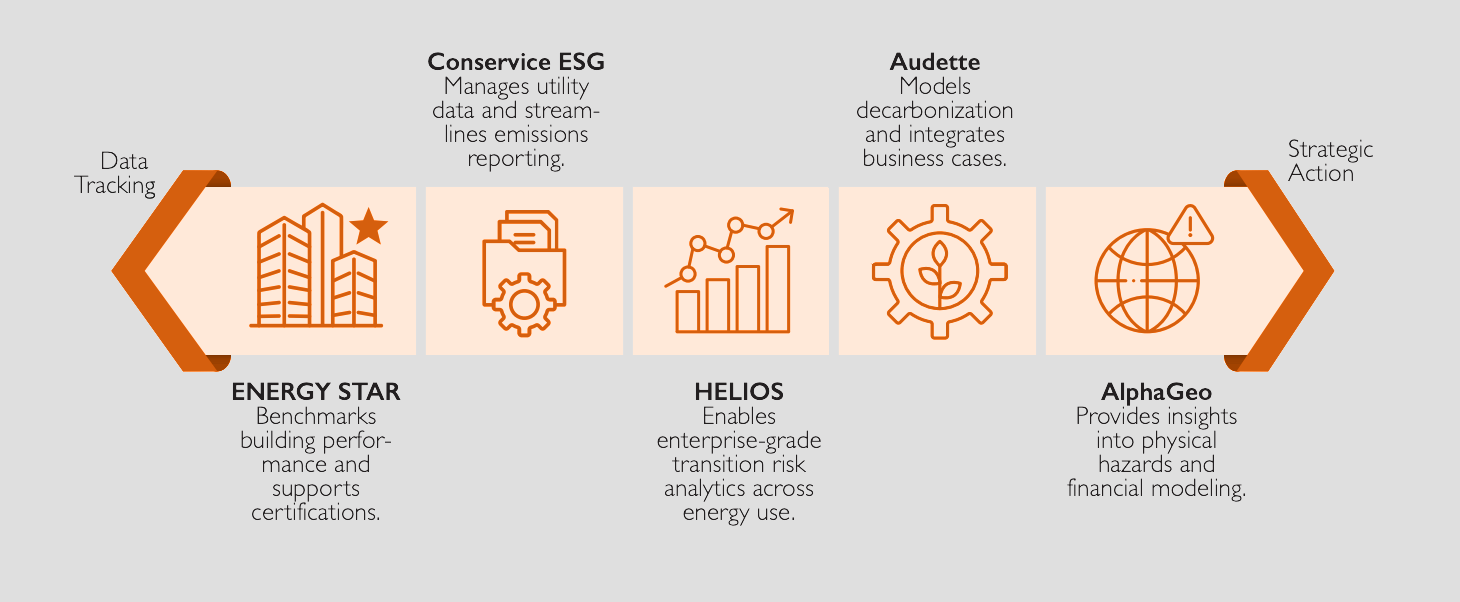

AlphaGeo is a key part of Stoneweg’s suite of interrelated and complementary platforms for climate intelligence. (Source: Varia US)

Results

Since transitioning to AlphaGeo, Stoneweg has been able to embed climate resilience more deeply throughout its operations, achieving:

1

A true resilience-focused approach:

AlphaGeo’s resilience-focused methodology introduced adaptation and resilience into Stoneweg’s climate-related processes. Teams are now able to identify actionable drivers of resilience, enabling proactive mitigation and, where relevant, opportunities for strategic arbitrage.

2

Organization-wide engagement:

AlphaGeo’s accessible, real estate-specific metrics resonate with professionals across departments, easing firm-wide adoption. The unlimited-user license also allows Stoneweg to easily enable access to embed climate considerations across the organization.

3

Streamlined sustainability workflows:

Intuitive metrics allowed real estate teams to engage directly with climate data, reducing reliance on sustainability staff. Sustainability teams also benefited from simplified reporting, saving time and effort while maintaining robust, TCFD-aligned outputs.

Looking Ahead

With the support of AlphaGeo’s actionable analytics, Stoneweg is committed to further integrating climate risk into its investment and asset management processes, empowering acquisition teams to address climate considerations as part of routine operations. Beyond risk mitigation, Stoneweg aims to leverage climate resilience and adaptation as opportunities for arbitrage and sustained value creation.