For power plant owners, operators, and investors, climate hazards have quickly become material financial risks. As electrical grids face increasingly severe and unpredictable conditions, the mismatch between aging infrastructure and shifting climate patterns is creating significant vulnerabilities.

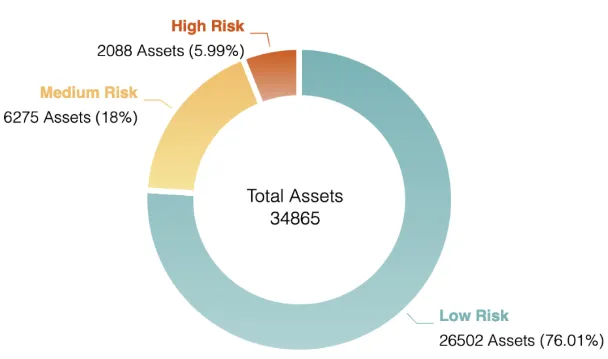

AlphaGeo’s latest analysis provides a comprehensive evaluation of over 34,000 power plants worldwide, measuring both acute and chronic climate risks and quantifying their financial impact. This assessment highlights where the sector faces the most urgent challenges and where adaptation strategies will be most critical.

Download Report

Key Takeaways:

1. Global Risk Exposure: By mid-century, 1 in 4 power plants will be exposed to medium-to-high resilience-adjusted climate risk — this rises to ~50% by 2100. Without adaptation, these risks could erode future earnings and asset valuations.

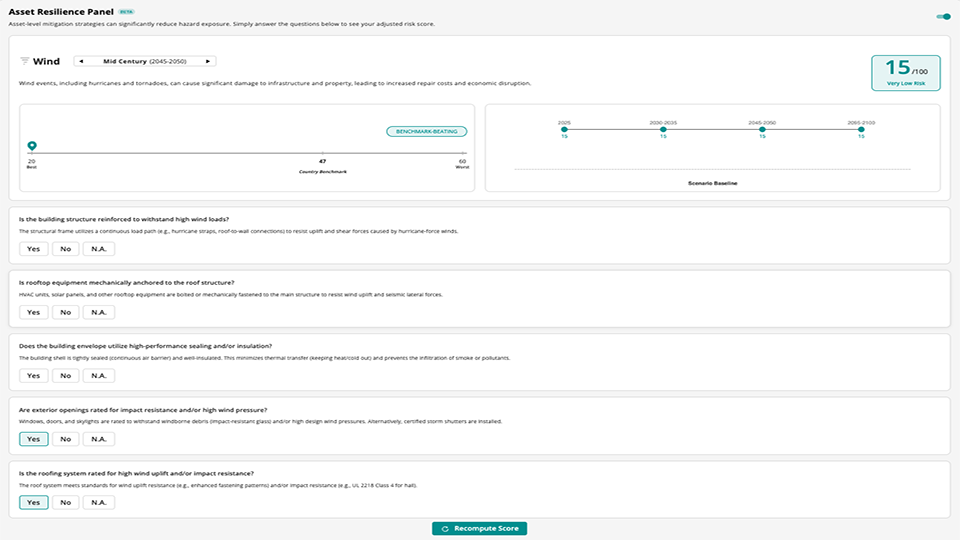

2. Primary Threats: The leading climate hazards are hurricane wind (~19%), wildfire (~19%), and heat stress (~17%). These can damage infrastructure, disrupt service, and jeopardize reliability — forcing costly preventative and recovery measures across many regions.

3. Regional Hotspots: Power plants in Sub-Saharan Africa, the Middle East, and South/Southeast Asia are most exposed to physical climate risks, especially extreme weather events. Assets in North America and Western Europe typically see lower risk, although localized threats remain.

4. Risk by Fuel Type: Coal power plants have the highest share of assets flagged as high risk, facing threats from wildfire, inland flooding, and hurricane winds. Oil and solar facilities are also among the most exposed, underscoring sector-wide vulnerabilities.

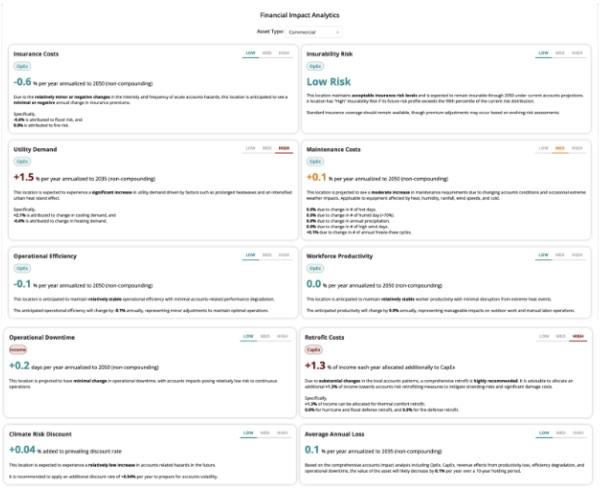

5. Financial Implications: Over 70% of assessed power plants are projected to face moderate-to-high increases in insurance premiums, retrofit costs, operational downtime, and efficiency losses. The scale of financial impact emphasizes the need for targeted adaptation and risk management strategies.

Learn more:

Visit us: www.alphageo.ai

Free trial: https://app.alphageo.ai/trial_setup