Industral Reinaissance Tracker (IRT)

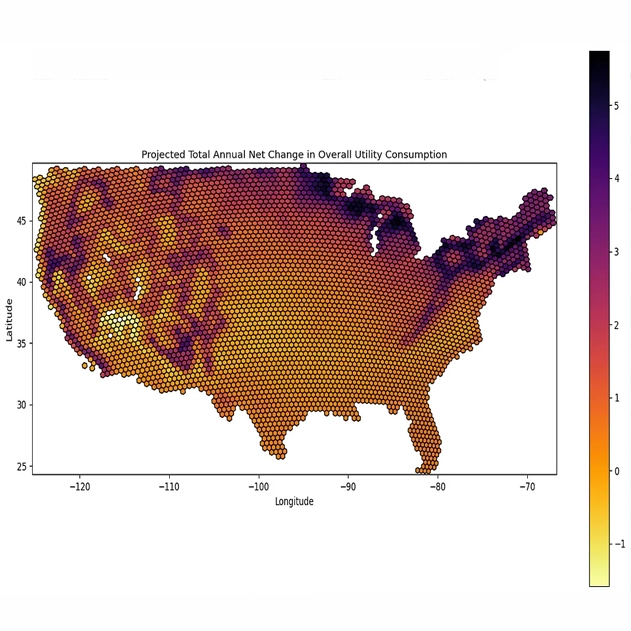

AlphaGeo’s Industrial Renaissance Tracker (IRT) guides investors in identifying the locations, sectors, and associated corporate tickers benefiting from new capital commitments across the US by correlating investment trends to our proprietary datasets.

Identify favorable locations and sectors amidst America’s industrial renaissance

NEWSLETTERS

Our monthly and quarterly GeoSense newsletters deliver insights from our hypothetical portfolios and discretionary research.

2024 Newsletters

2025 Newsletters

Contact AlphaGeo to discuss access to our suite of market forcecasting tools: [email protected]

Disclaimer: This material, which may be considered advertising, is for general information purposes only and is not intended to provide legal, tax, accounting, investment, financial or other professional advice on any matter. Past performance is not indicative of future performance. This material has been provided for information purposes only to professionals and institutions. The provision of this material and/or reference to specific assets, commodities, funds, securities, sectors, or markets does not constitute investment advice, or a recommendation to buy or sell any security, or an offer of any regulated financial activity. Investors must consider the investment risks, objectives, investment horizon and associated investment parameters of any investment carefully before investing. Opinions, estimates, forecasts, projections and statements of financial and/or market trends are based on market conditions at the date of the publication, constitute the judgment of the authors, and are subject to change. There can be no guarantee that information contained as part of a market outlook will be met. Investing in publicly traded securities, assets and/or funds involves risk, including the possible loss of principal. Shares of any asset, exchange-traded fund (ETF) or other investment vehicle are bought and sold at market price may trade at a discount. Brokerage commissions will reduce returns. Hypothetical portfolios are constructed with monthly rebalancing and reinvestment of dividend parameters. This material may not be comprehensive or up to date and there is no undertaking as to the accuracy, timeliness, completeness or fitness for a particular purpose of information given. AlphaGeo (and related entities) will not be responsible for updating any information contained within this material and opinions and information contained herein are subject to change without notice. AlphaGeo, Climate Alpha, and related entities, assume no direct or consequential liability for any errors in or reliance upon this material. We have not and do not intend to provide this information to or otherwise solicit individual (a/k/a retail) investors. This material does not constitute a recommendation or advice by AlphaGeo, Climate Alpha, or any related entities, of any kind. You should discuss this material with appropriate advisors in the context of your circumstances before acting in any manner on this material or agreeing to use any of the referenced products or services and make your own independent assessment (based on such advice) as to whether the referenced products or services are appropriate or suitable for you.