Global real estate — spanning residential, commercial, and agricultural land — was valued at $379.7 trillion in 2022.

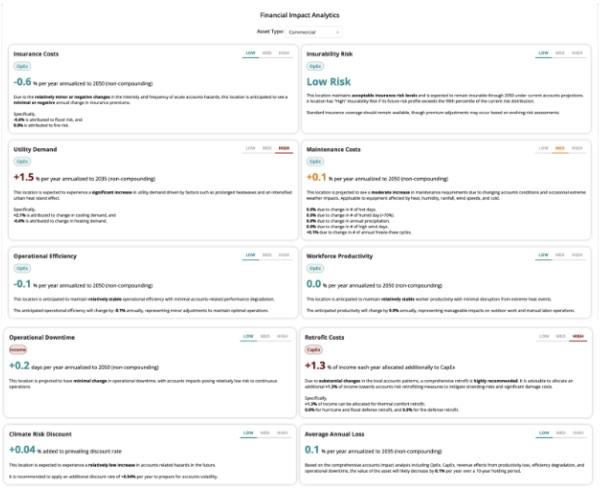

Physical climate risks threaten this massive asset base with mounting financial impacts. The projected financial impact on real estate from physical risks is $54 billion by 2050, while broader corporate climate exposure reaches $1.2 trillion by the 2050s.

Despite these projections, the adaptation economy remains under-resourced and critically under-measured. Traditional climate risk assessments provide location-level hazard scores — telling investors where risks exist — but fail to account for what’s been done to mitigate those risks. A data center in Miami equipped with flood defenses, backup power systems, elevated infrastructure, and hurricane-rated construction faces vastly different risks than an identical facility without these measures. Yet conventional risk models treat them identically.

This measurement gap creates three critical problems. First, capital misallocation: investors can’t differentiate between well-adapted and vulnerable assets in the same location. Second, adaptation value: asset owners implementing adaptation strategies can’t quantify the risk reduction and ROI achieved.

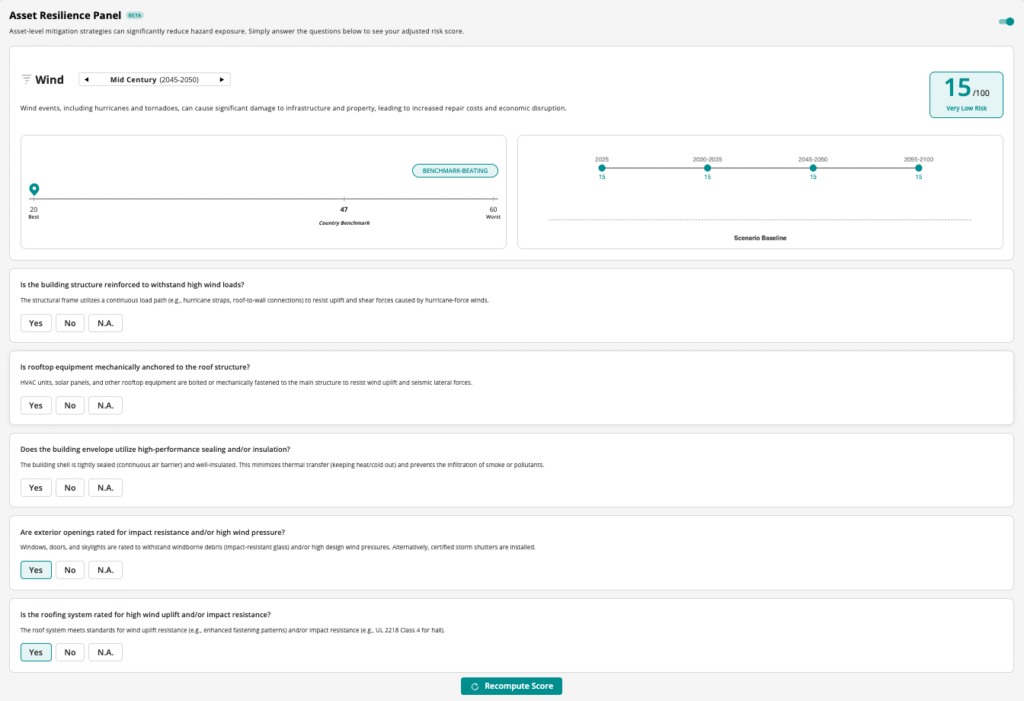

Introducing our Asset Resilience Panel

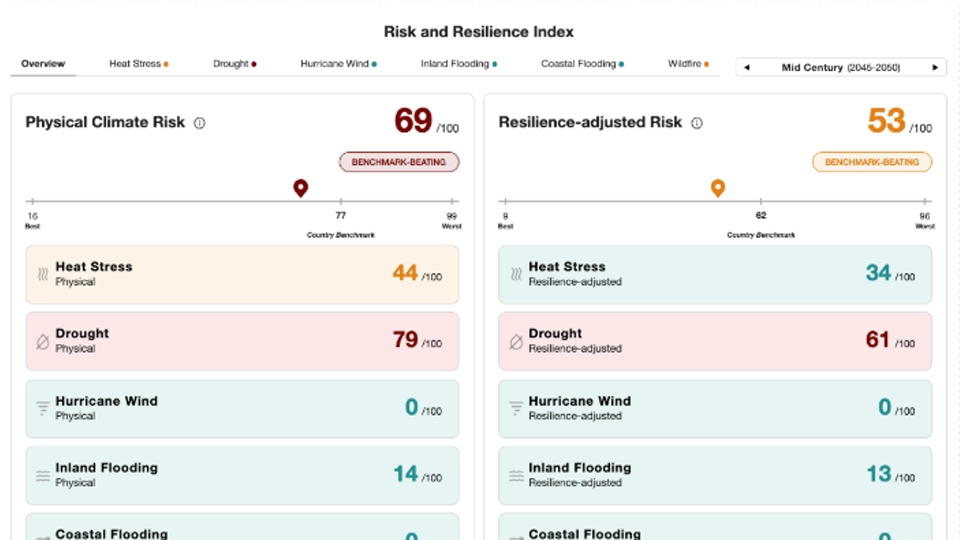

This is why we’re launching our latest tool, the Asset Resilience Panel (ARP), to help asset managers quantify the impact of asset-level adaptation measures on real-world risk. The Asset Resilience Panel synthesizes over 100 adaptation strategies from leading technical standards into a single, rigorous assessment tool. By integrating physical attributes and adaptation measures with our proprietary Climate Risk and Resilience Index (RRI) scores, the Panel re-computes an Asset-level Risk Score that reflects both locational exposure and asset-level resilience.

How It Works

- Open any asset

In single‑asset view, toggle on the Asset Resilience Panel to see baseline hazard risk for Heat Stress, Drought, Wind, Inland and Coastal Flooding, Wildfire, Hail, Landslide, and Earthquake.

- Complete the checklist

For each hazard, answer a short set of questions on site conditions, building design, and critical systems (e.g. elevation, drainage, shading, fire‑resistant materials).

- Get an adjusted risk score

The engine weights each measure by its impact on that hazard and instantly updates an Asset‑level Risk Score, showing how much existing adaptations reduce risk versus the location‑only baseline.

- See gaps and next steps

Missing high‑impact measures are flagged as priority opportunities, giving you a ready‑made list of adaptation actions to feed into capex planning, due diligence, or underwriting

As climate adaptation is not one-size-fits-all. AlphaGeo models adaptation measures that are specific to each hazard. For heat stress, for instance, reflective roofing counts as a measure, while elevated structures help mitigate flood risk.

By mapping each adaptation measure to precise hazards, our model calculates granular, hazard-specific mitigation impacts. This enables investors to quantify the risk reduction impact and ROI of remediation efforts, identify remaining adaptation gaps (based on missing high-impact measures), and avoid “adaptation theater” — the false sense of security from measures that don’t address material risks.

Why it matters

For most investors, the physical climate risk models provide only one part of the answer. The Asset Resilience Panel helps surface insights on which assets are genuinely well‑adapted, where the biggest adaptation gaps sit, and which interventions deliver the most risk reduction per dollar invested. That creates a practical bridge between climate models, engineering reality, and day‑to‑day decisions on capex, underwriting, and portfolio strategy.