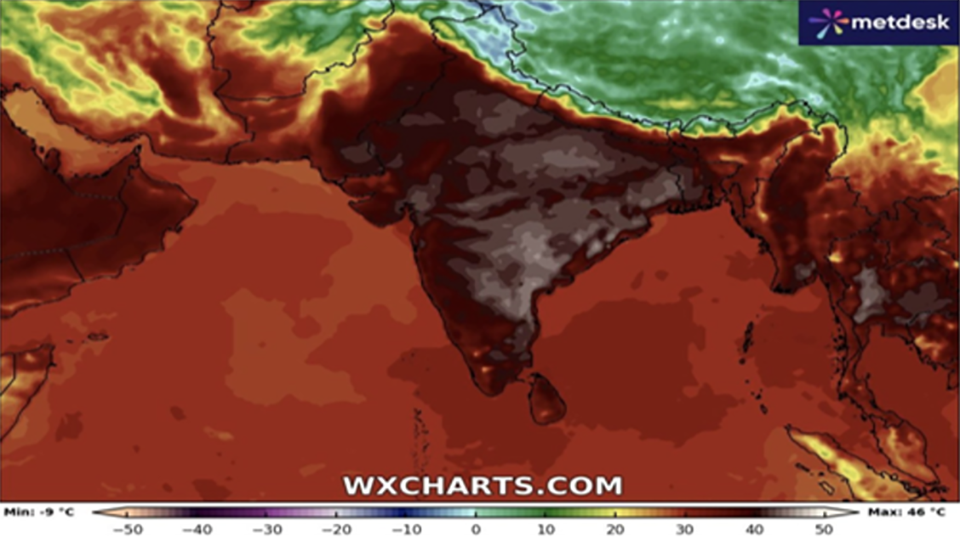

For institutional investors and large corporations, climate volatility is no longer a future threat; it is an immediate, quantifiable risk posing new challenges to investors and businesses worldwide. Raw climate data, however, is complex; what investors and businesses need is climate intelligence — the ability to query, analyze, and act upon complex climate data instantly and confidently.

AlphaGeo and Snowflake have established a partnership designed to deliver actionable climate intelligence. This collaboration integrates AlphaGeo’s granular, proprietary geospatial analytics with the advanced agentic capabilities of Snowflake Intelligence, transforming complex climate data into actionable, explainable intelligence.

AlphaGeo’s Advanced Analytics Meets Snowflake’s Agentic Intelligence

The synergy between our offerings is the creation of a seamless, governed environment where high-fidelity climate data doesn’t just reside — it actively drives foresight and competitive advantage.

1. Granular, Global Geospatial Analytics via AlphaGeo

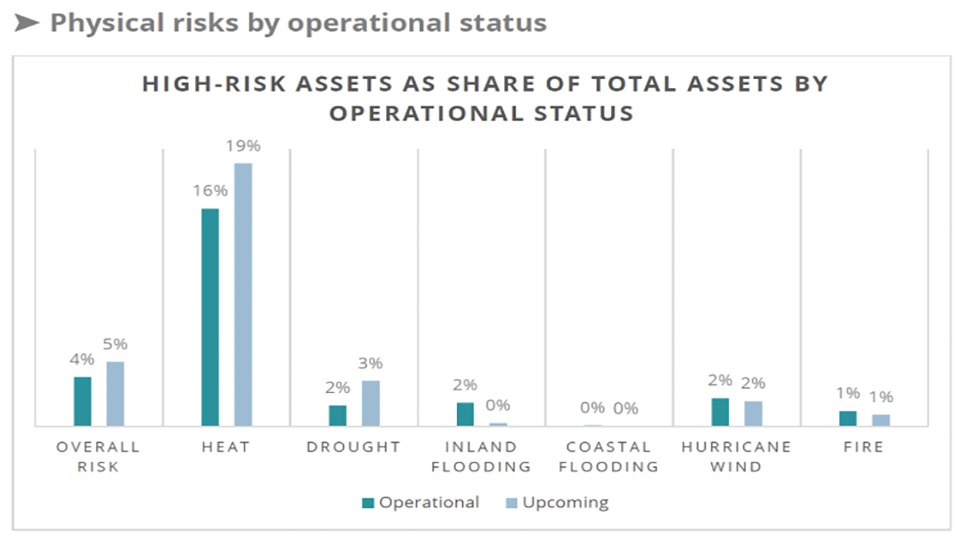

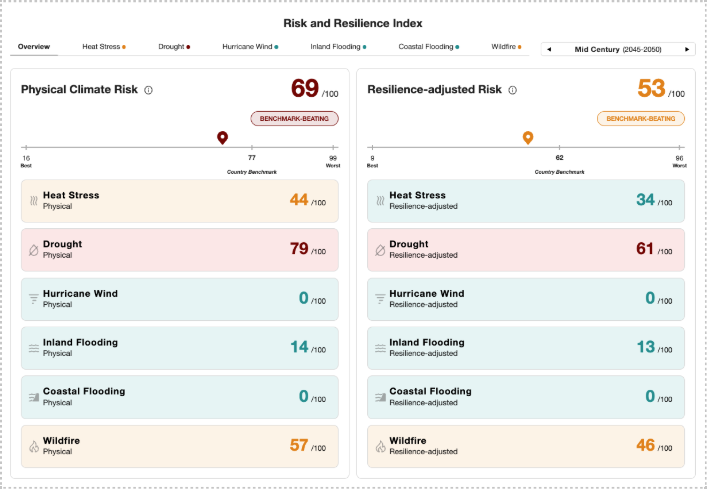

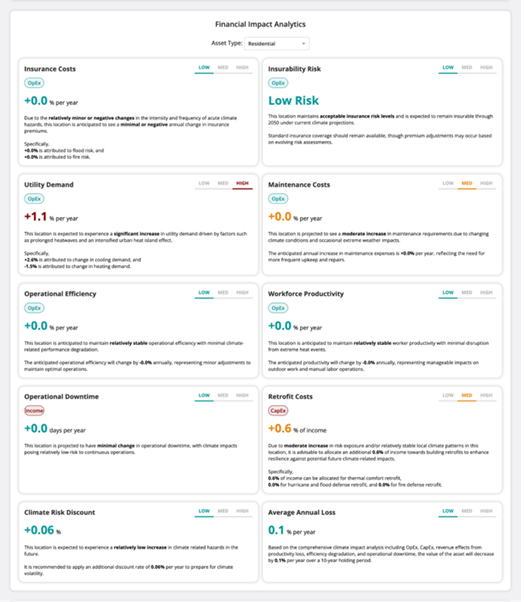

How do you price the increased insurance costs for a property located in a high-flood-risk zone or the potential decrease in asset value due to increased wildfire frequency? AlphaGeo addresses this challenge with its proprietary Climate Risk and Resilience Index and Financial Impact Analytics suite. Together, these products present a revolutionary approach to quantifying, adapting to and acting on climate risk for banks, insurers and asset managers.

Where others see only risk, we map resilience: our unique methodology models risk, quantifies adaptation gaps, calculates financial impact and measures overall resilience. Ourtools empower financial institutions to:

- Quantify physical climate risk: AlphaGeo delivers precise, location-level scoring of physical climate risks — including floods, heat waves, droughts, wildfires, hurricanes and sea-level rise — across multiple future scenarios up to 2100. A bank, for example, can pinpoint flood risk variances across its mortgage portfolio at the address level.

- Factor in local resilience: The Global Adaptation Layer enhances accuracy by incorporating real-world resilience infrastructure — such as seawalls, drainage systems and fire response networks — creating a “ground truth” view of actual exposure. This transforms generic hazard maps into investment-grade risk intelligence.

- Embed climate into financial models: AlphaGeo’s Financial Impact Analytics suite integrates directly with cash flow and valuation models. It adjusts for location-specific OpEx (for instance, rising insurance and utility costs) and CapEx (for instance, retrofit investments) and recalibrates discount rates to reflect climate uncertainty. These metrics can be calibrated for 9 asset types, spanning real estate and infrastructure.

2. Agentic Analysis via Snowflake Intelligence

Snowflake Intelligence serves as the unified, secure enterprise agent that eliminates the complexity barrier inherent in massive, high-dimensional data. This is particularly crucial when querying complex geospatial climate data. With Snowflake Intelligence, AlphaGeo customers on Snowflake can now:

- Accelerate insights with natural language: Ask questions about portfolio-wide exposure, scenario outcomes, or asset-level risk in natural language — and receive trusted, coherent responses within seconds.

- Refine analysis instantly: The enterprise agent allows for iterative, natural language refinement of analysis, ensuring that your climate risk models are always based on the most relevant parameters.

- Secure & governed Scaling: All insights generated on the platform are managed under Snowflake’s robust governance framework. This allows you to scale your climate risk analysis globally and across all business units securely, ensuring compliance and data lineage for critical regulatory disclosures.

From Data to Decisions

The ultimate outcome of this partnership is the conversion of predictive analytics into immediate, high-impact decisions. With the data-to-intelligence pipeline of the Snowflake-AlphaGeo partnership, financial institutions can:

- Refine underwriting & lending: Use AlphaGeo’s risk and financial impact analytics to accurately price risk, assessing collateral and loan portfolio vulnerability in real-time.

- Optimize Capital Planning: Confidently identify assets facing imminent climate depreciation and prioritize capital expenditures towards demonstrably climate-resilient investments.

- Gain an investment edge: Execute faster on asset acquisition, divestiture, and corporate structuring by embedding predictive climate intelligence directly into risk management and investment strategy.

Conclusion

The AlphaGeo and Snowflake partnership is designed to establish data-driven climate leadership. By combining our specialized, granular analytics with Snowflake’s agentic capabilities, we equip your organization to transform climate risk from a liability into a source of enduring, competitive value.