Executive Summary

AlphaGeo’s latest report provides a systematic assessment of physical climate risks across India’s leading office markets, in partnership with Propstack. This report combines AlphaGeo’s climate risk and financial impact analytics with Propstack’s transaction-level leasing data from major real estate investment trusts (REITs) — Brookfield, Mindspace, Embassy, and Knowledge Realty Trust.

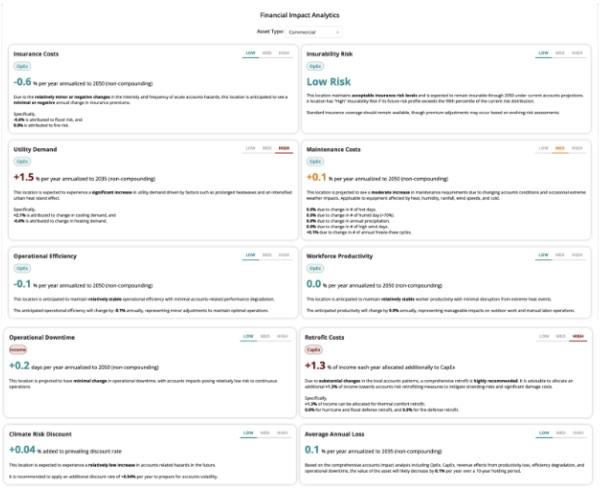

Our findings show that slightly over 40% of all REIT assets analyzed have medium-to-high exposure to physical climate hazards, with heat stress, drought, and wildfire posing the most significant risks. This is expected to result in significant financial impact, with over 90% of assets expected to see a medium-tohigh increase in insurance premiums, retrofit costs, and discount rates due to elevated risks.

Methodology & Data Sources

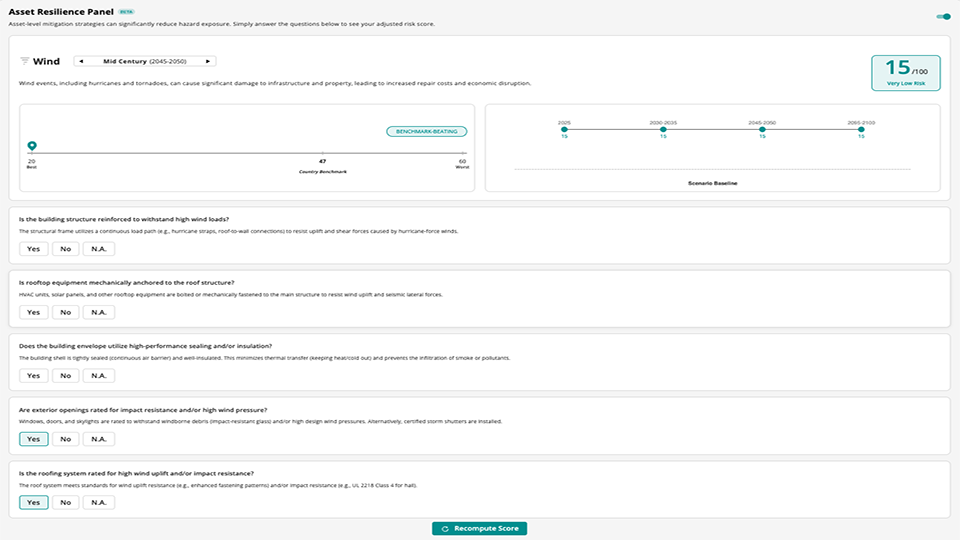

Climate analytics (AlphaGeo): Physical climate risk scores across six hazards, adjusted for resilience features like green cover, flood defense, emergency infrastructure, and climate-adaptive design. Risks are modelled at the city-level, under the SSP 3–7.0 (medium emissions) scenario, based on CMIP6 ensemble models. City-level data was used in this analysis.

Transaction data (Propstack): Over 5,000 commercial lease records analyzed across Gurgaon, Kolkata, Noida, Delhi, Mumbai, Pune, Bangalore, and Hyderabad, including data on building sizes, lease terms, sectors, and asset locations.

Key Findings

- Highest Risks: Just over 40% of all assets face medium-to-high exposure to physical climate hazards, with the highest exposure to heat stress, drought, and wildfire. All assets analyzed are projected to face medium-to-high risks of heat stress by 2050. Inland flooding poses moderate risks to assets in Noida and Kolkata, while assets in Kolkata also face moderate coastal flooding risks. Hurricane wind poses medium risks for a few assets in Chennai and Kolkata.

- Financial Impact: By 2050, over 90% of assets analyzed will face medium-to-high increases in insurance costs, retrofit expenses, and climate-adjusted discount rates. Around half of all assets are expected to experience moderate increases in utility demand, driving up OpEx.

Read the Full Report

Download the full report for in-depth insights into physical climate risks and financial impact for 8 key Indian cities and major Indian REITs, including Brookfield, Mindspace, Embassy and Knowledge Trust.