Safeguard loan portfolios against climate-induced devaluations, enhance risk management, and ensure compliance with climate stress tests and regulatory disclosures.

DATA PRODUCT

USE CASE

Risk management

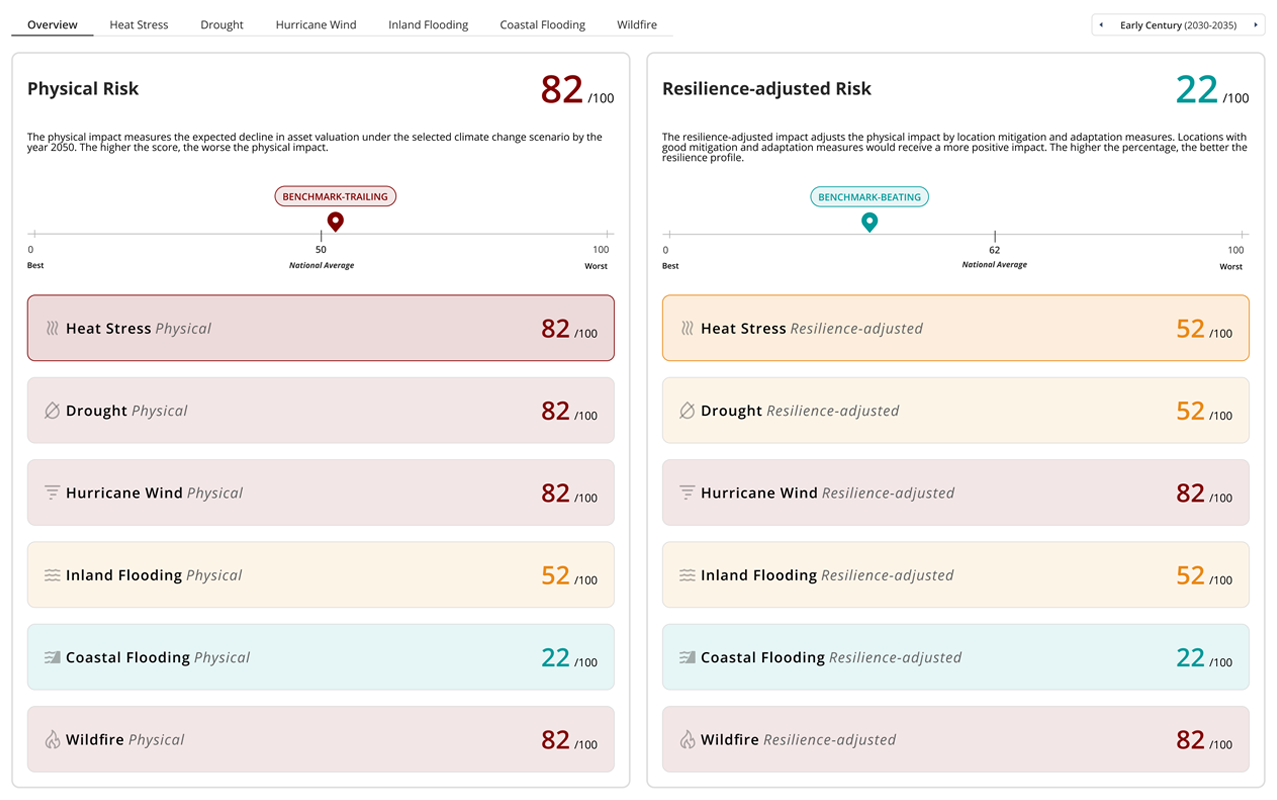

Assess physical climate risk exposure across mortgage, commercial, and investment books with property-level precision.

USE CASE

Stress Testing and Scenario Planning

Leverage IPCC-aligned climate scenarios for short-, medium- and long-term for regulatorily-aligned climate stress tests and scenario planning.

USE CASE

Regulatory Disclosures

Disclose climate physical risk exposures, assess impact of adaptation measures, and conduct scenario analyses in line with regulatory standards.

USE CASE

Due Diligence and Underwriting

Integrate climate scenarios into pricing and underwriting of mortgage-backed securities.

USE CASE

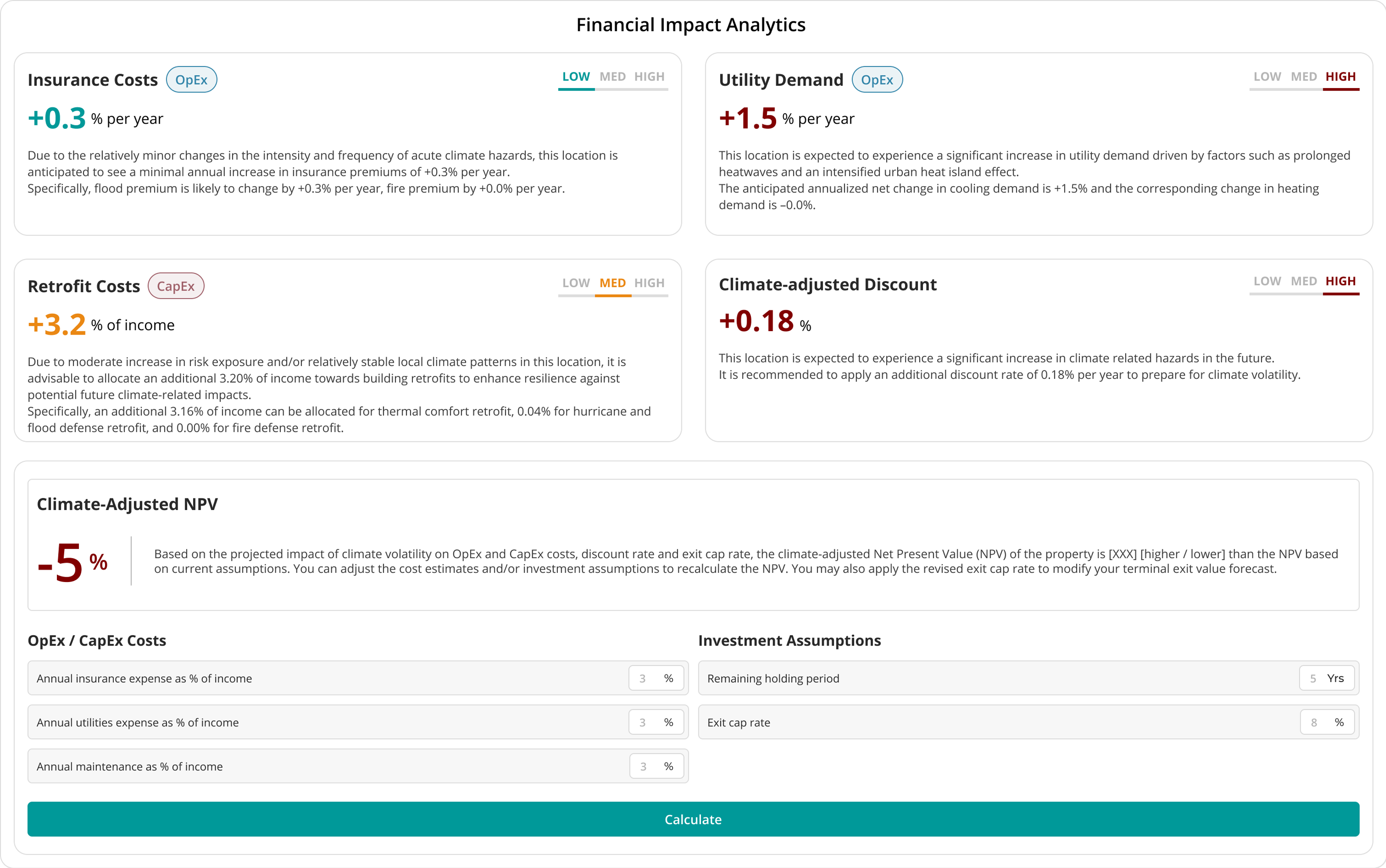

Model Credit Risk

Calculate climate impact on cashflows and valuations to understand impact on credit risk.

USE CASE

Operational Risk Management

Simulate the impact of climate change on bank infrastructure and operational costs.

DATA PRODUCT

To provide the best experience, we use technologies like cookies to store and/or access device information. Not consenting or withdrawing consent may adversely affect certain features and functions. Please read our Legal Items and Disclosures for more information.

To provide the best experience, we use technologies like cookies to store and/or access device information. Not consenting or withdrawing consent may adversely affect certain features and functions. Please read our Legal Items and Disclosures for more information.