Asset management

Predictive location analytics for resilient investing

Quantify climate risk and financial impact, to construct future-proof portfolios across public and private markets.

DATA PRODUCT

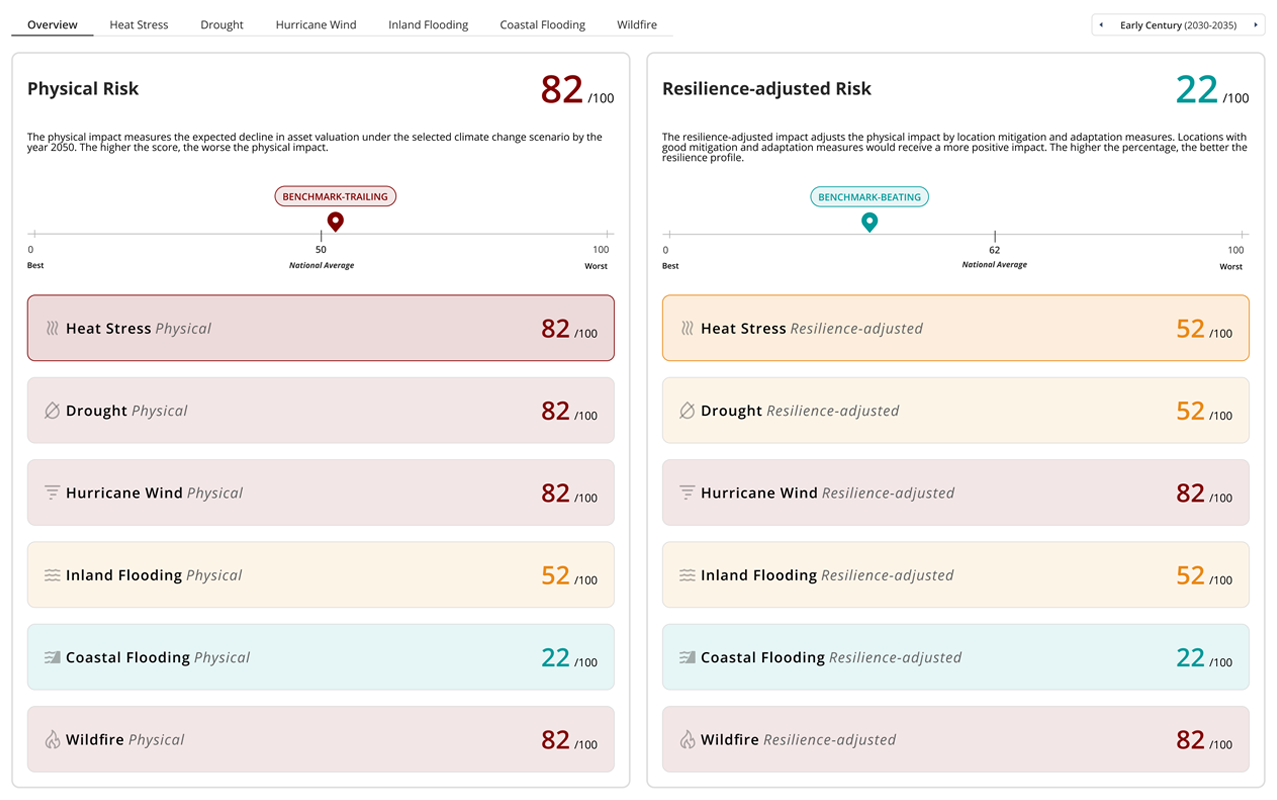

Climate Risk & Resilience Index

USE CASE

Thematic investment screening

Screen, rank, and prioritize investments across public and private markets based on climate risk and resilience profile for the construction of thematic portfolios, indices, and other financial products.

USE CASE

Multi-asset risk and resilience assessment

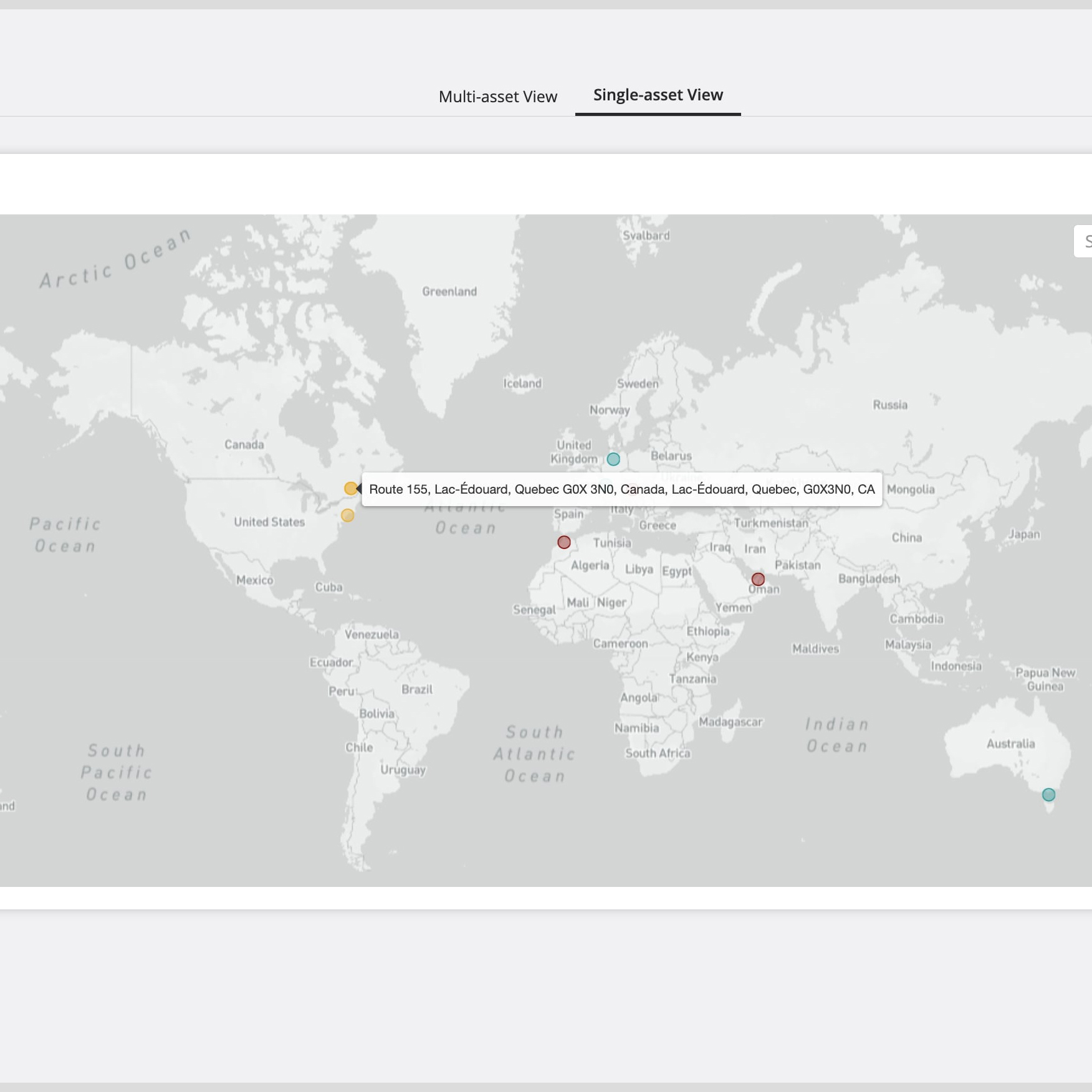

Conduct multi-scenario, multi-timescale analysis of portfolio or asset-level risk and resilience across multiple asset classes (real assets, C/RMBS, REITs, private equity, equities, credit, etc.).

USE CASE

Regulatory reporting and stakeholder engagement

Assess the impact of climate risks on financial performance for regulatory compliance and stakeholder reporting.

USE CASE

Thematic investment screening

Screen, rank, and prioritize investments across public and private markets based on climate financial impact profile for the construction of thematic portfolios, indices, and other financial products.

USE CASE

Investment research and analysis

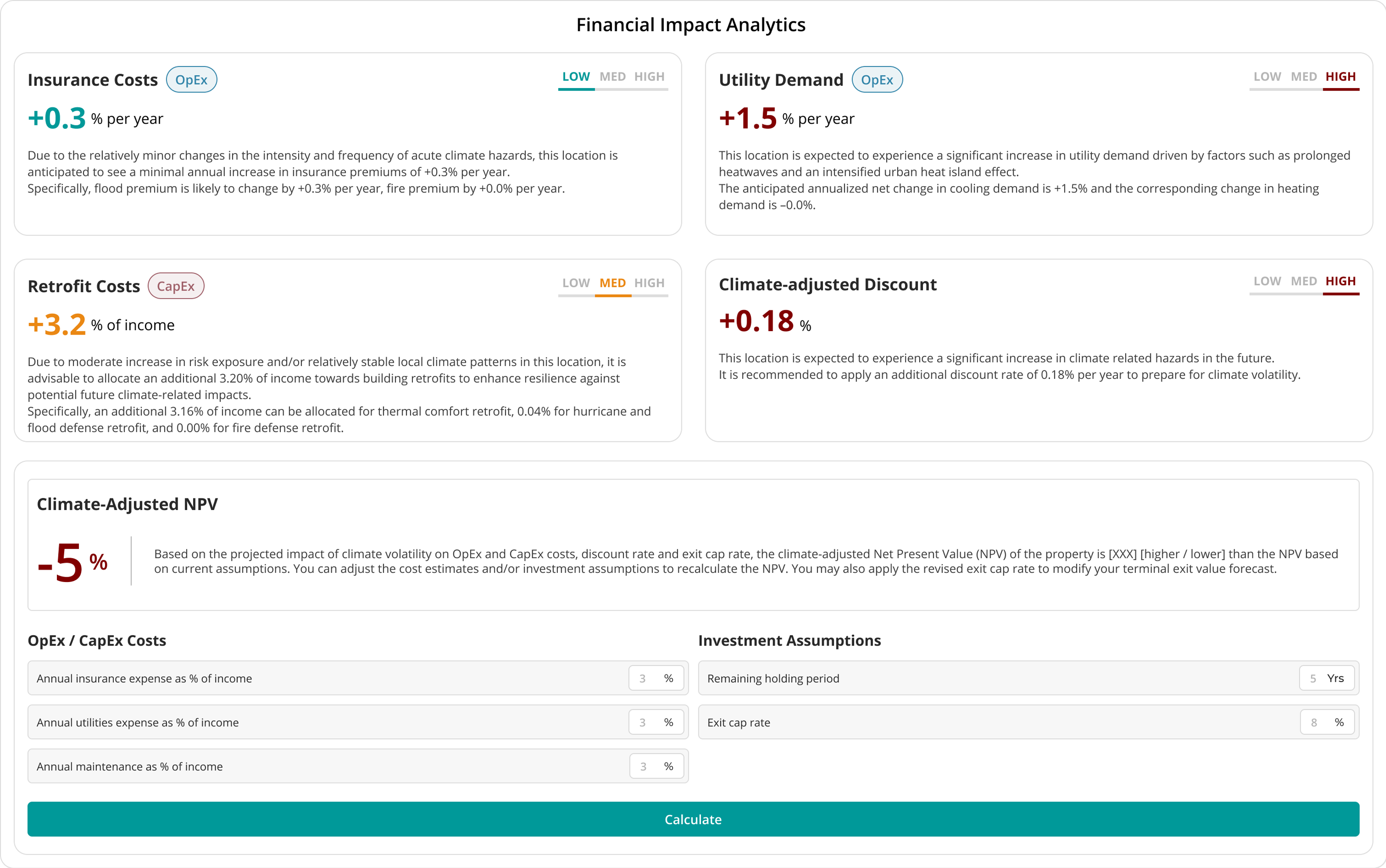

Develop more robust cashflow and valuation models using our climate-adjusted OpEx, CapEx, and discount rate metrics.

USE CASE

Regulatory reporting and stakeholder engagement

Assess the impact of climate risks on financial performance for regulatory compliance and stakeholder reporting.

DATA PRODUCT

Financial Impact Analytics

Case studies

Oaktree

Oaktree, a leader among global investment managers specializing in alternative investments, wanted to quantify its exposure to physical climate risk underneath its complex composition of real estate equity, private loans and traded securities. AlphaGeo worked closely with the firm to pinpoint climate risk, attribute it by fund, and calculate its potential impact over time. In analyzing the financial impact of climate volatility on its portfolios, Oaktree was able to rank and compare its asset performance across existing – and future – investments.

Atlas Capital

Atlas Capital was mandated to build a systematic investment index comprising multiple asset classes including REITs. AlphaGeo integrated multiple data streams from institutional vendors and provided risk-adjusted valuation for more than 150,000 REIT properties under multiple climate scenarios. This analysis was delivered on a custom interactive dashboard that ranks and clusters REITs according to location, property type, and other metrics, with quarterly updates based on the latest market data, allowing for algorithmic management of the Atlas Sustainable REIT Index.

FEATURED INSIGHTS

Beyond VaR: Underwrite Climate Risk with Climate-Adjusted NPV

4 February, 2026

Mapping Opportunity: How Geospatial Data Can Drive Investments in Climate Adaptation

22 May 2025

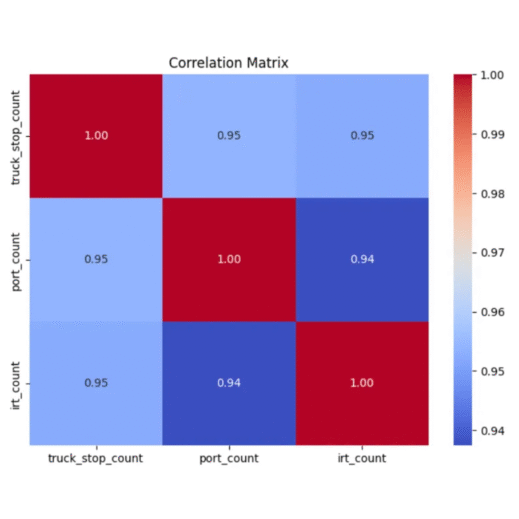

Industrial Renaissance Tracker (IRT) Update: Insights into Investment and Logistic Clusters

29 January 2025

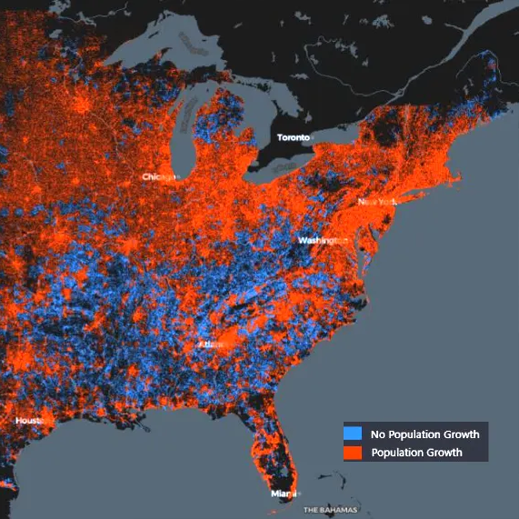

Climate Migration in America: Environmental and Economic Considerations

14 January 2025