For decades, global supply chain strategy prioritized a singular objective: efficiency. Networks were designed under the assumption that the physical infrastructure of trade — rivers, canals, and ports — would remain static variables. However, this assumption is increasingly challenged by a shifting climatic regime. While geopolitical fragmentation and tariff volatility often dominate market analysis, chronic and acute climate stressors have emerged as fundamental operational constraints.

These effects are already felt: A staggering 99% of executives surveyed by the Economist reported that their operations have been impacted by climate change. Climate change has now joined geoeconomics as a definitive force reshaping global trade strategies, forcing companies to balance efficiency with resilience.

1. The Mechanics of Climate-Driven Disruption

Climate disruptions mean longer delivery times, higher costs and lower output for global supply chains. The Economist reports that economic risks of climate change to global trade are predicted to sit around US$81bn.

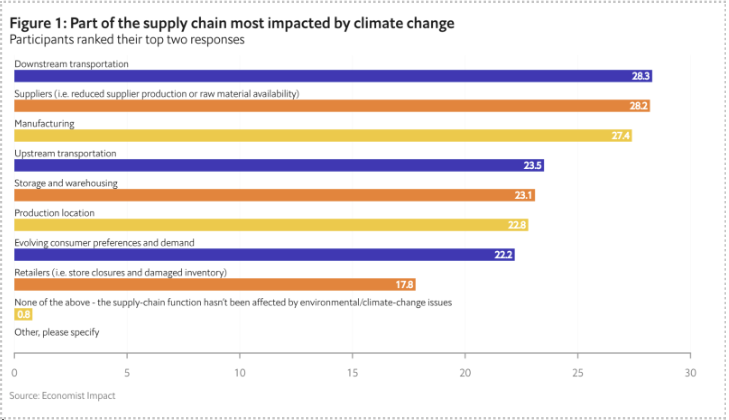

Crucially, this disruption permeates the entire value chain. As indicated in Figure 1 below, vulnerability is not isolated to a single node. While downstream transportation is the most impacted function (cited by 28.3% of respondents), it is closely followed by supplier production (28.2%) and manufacturing (27.4%). This data confirms that risk is omnipresent — from the raw material source to the final mile.

Examples of this disruption abound. In late 2024, for instance, Hurricane Helene struck North Carolina, a region situated far inland from typical hurricane tracks. While the immediate impact involved flooding, the systemic shock was specific to the semiconductor industry. The event halted operations in Spruce Pine, the source of 70-90% of the world’s high-purity quartz.

This incident echoes the 2011 Thai Floods, a textbook example of cascading failure, where localized flooding paralyzed the global hard disk drive (HDD) and automotive sectors. These events demonstrate how a single extreme weather event in a “Tier N” supplier location can threaten global production capacity.

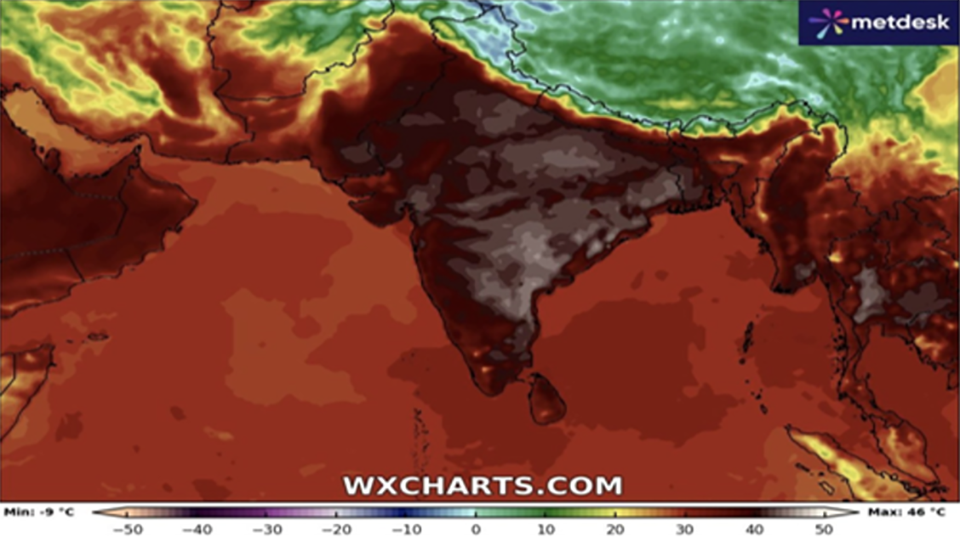

Beyond acute disasters, chronic shifts in baseline environmental conditions are eroding logistical capacity.

- The Panama Canal: In 2023 and 2024, severe drought in the Gatún Lake watershed compelled the Canal Authority to slash daily vessel transits by nearly 40%.

- The Rhine River: In Europe, fluctuating water levels on the Rhine have frequently forced barges to operate at reduced capacity. Data from the Kiel Institute indicates that a month of low water on the Rhine can reduce German industrial production by approximately 1%, highlighting the direct link between hydrological volatility and industrial output.

AlphaGeo: Resilience Intelligence for Supply Chains

Conventional risk management frameworks often rely on static flood maps or sovereign-level indices. However, these tools frequently lack the granularity required to drive asset-level decision-making in a complex global network. AlphaGeo empowers organizations “Resilience Intelligence” that models complex climate risks alongside the traditional macroeconomic, geopolitical, and other challenges faced by global supply chains.

With AlphaGeo, supply chain analysts can:

1. Conduct granular climate physical risk assessments

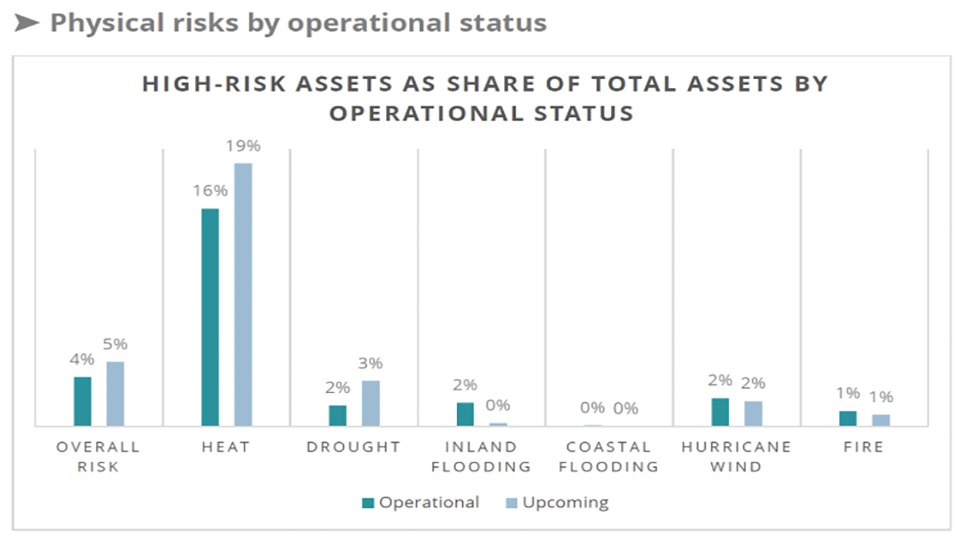

Effective risk management requires high-resolution visibility. AlphaGeo’s Climate Risk and Resilience Index provides a climate physical risk score for nine physical hazards at the coordinate-level.

This approach identifies hidden concentrations of risk within the supplier network—such as a critical component manufacturer located in a zone with high flood exposure and insufficient local drainage infrastructure.

2. Model adaptation capacity and plan for resilience

Hazard exposure does not always equate to asset vulnerability. Unique to the market, AlphaGeo integrates a Global Adaptation Layer into its risk scoring. This methodology differentiates between a port in a storm-prone region that has invested in resilience measures (e.g., sea walls) versus one that has not.

This distinction allows procurement teams to engage with suppliers on resilience upgrades rather than defaulting to market exit strategies. It also allows teams to identify adaptation gaps that can be actionably remedied.

3. Evaluate financial impact of physical risks

For financial decision-makers, physical hazard scores are not the critical metric, but its financial impact. AlphaGeo’s Financial Impact Analytics suite translate climate hazards into financial metrics that matter for supply chain analysts concerned about the capacity of their key supply nodes. This includes forecasts of climate’s impact on productivity levers such as operational downtime, efficiency loss, and workforce productivity.

4. Model traditional macro-risks alongside climate

AlphaGeo’s Location Macro Signals complements our climate resilience suite, allowing decision-makers to evaluate the complex, intersecting risks that face global supply chains. It is a geospatial macro-intelligence tool that curates geopolitical, macroeconomic, sociodemographic, and governance indicators globally to help organizations spot risks and opportunities for any location.

Clients use this to:

- Identify Compound Vulnerabilities: For instance, to spot locations where high physical risk converges with low institutional resilience (e.g., labor instability or weak rule of law).

- Spot Opportunity: Conversely, to identify “safe haven” locations that combine environmental stability with strong economic growth signals.

Conclusion

Global supply chains of the coming decade will be defined by their ability to absorb shock. By integrating AlphaGeo’s geospatial analytics – spanning climate to macro-intelligence — into core operational planning, organizations can move from reactive measures to structural resilience, ensuring their networks are prepared for the environmental and macro shifts ahead.

Learn more:

Visit us: www.alphageo.ai

Free trial: https://app.alphageo.ai/trial_setup