Investment Strategies

AlphaGeo leverages geospatial data science to guide asset managers in discovering resilient investment opportunities across public and private markets.

Future-proof portfolio construction with AlphaGeo

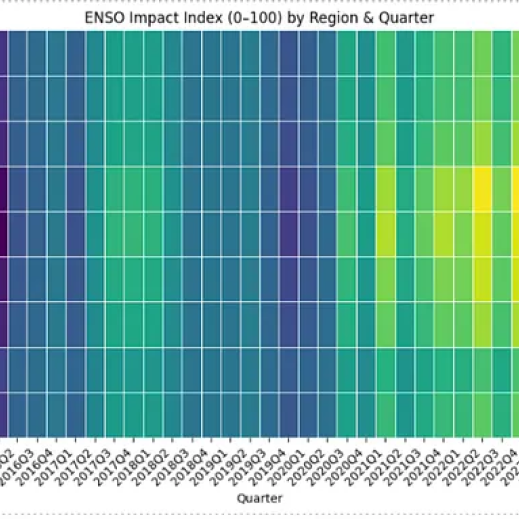

Measure financial materiality

Use our proprietary spatial finance methods to quantify the impact of climate volatility on earnings for investment analysis.

Identify thematic opportunities

Forecast market shifts across key sectors such as real assets, commodities, energy, mobility and others.

Construct resilient portfolios

Leverage an array of geospatial drivers that generate alpha signals for asset selection and portfolio rebalancing.

BENEFITS

How clients win with AlphaGeo’s proprietary software

Rebalance portfolios with our robust financial impact metrics

Boost returns by investing in high-performing assets

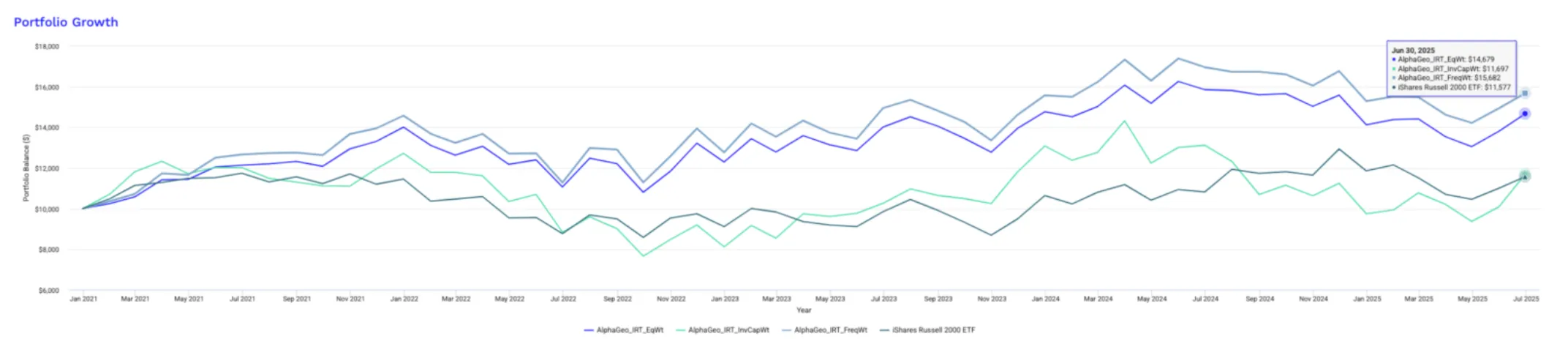

Case study: Our “Industrial Renaissance Tracker” ETF outperforms the market

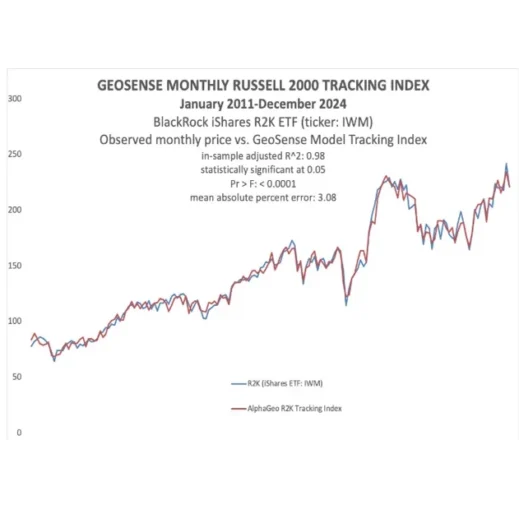

AlphaGeo builds market tracking indices, the first of which is benchmarked to the BlackRock iShares Russell 2000 ETF (ticker: IWM). The training data for this model includes a broad combination of macroeconomic, environmental and socioeconomic factors, and the index exhibits a statistically significant relationship between these independent variables and the dependent variable: in this case, IWM. The tracking index includes one, two and three-month projections.

Locate and monetize climate resilient geographies for arbitrage opportunities.

Generate relative performance analytics for asset acquisition and fund construction.

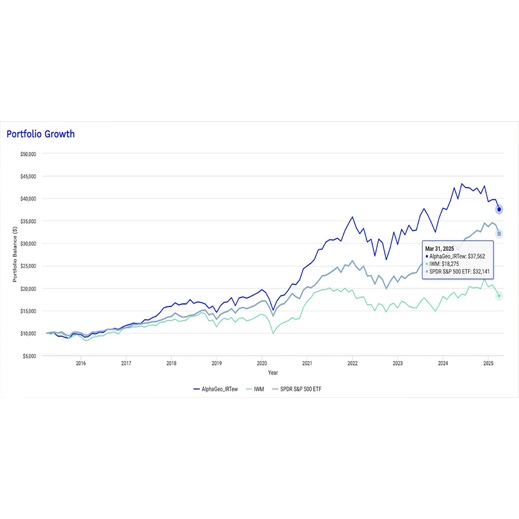

Case Study: Our custom tracking index predicts market movement

AlphaGeo builds market tracking indices, the first of which is benchmarked to the BlackRock iShares Russell 2000 ETF (ticker: IWM). The training data for this model includes a broad combination of macroeconomic, environmental and socioeconomic factors, and the index exhibits a statistically significant relationship between these independent variables and the dependent variable: in this case, IWM. The tracking index includes one, two and three-month projections.

INVESTMENT STRATEGY MEMOS

AlphaGeo Investment Memos deliver insights from our discretionary research and custom portfolios.

2024 Newsletters

2025 Newsletters

Contact AlphaGeo to discuss access to our suite of market forcecasting tools: [email protected]

FEATURED INSIGHTS

Beyond Emissions: Physical Risk and Adaptation for Data Centers

14 August 2025

Climate Oscillations and the U.S. Housing Market

6 August 2025

Decentralized Energy: Driving alpha in real estate investing

June 2025

AlphaGeo Industrial Renaissance Tracker

21 April 2025

Path Dependencies Between the Atmosphere and the Economy

9 April 2025

January 2025 GeoSense Market Intelligence Note: All That Glitters

31 January 2025

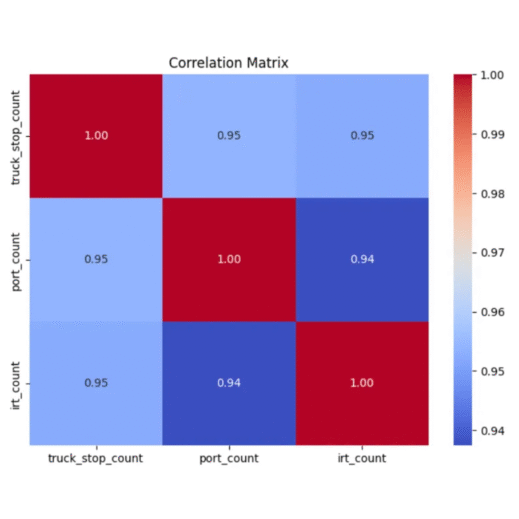

Industrial Renaissance Tracker (IRT) Update: Insights into Investment and Logistic Clusters

29 January 2025

January 2025 GeoSense Market Intelligence Note: All That Glitters

27 January 2025