INSURANCE

Predictive location analytics for resilient underwriting

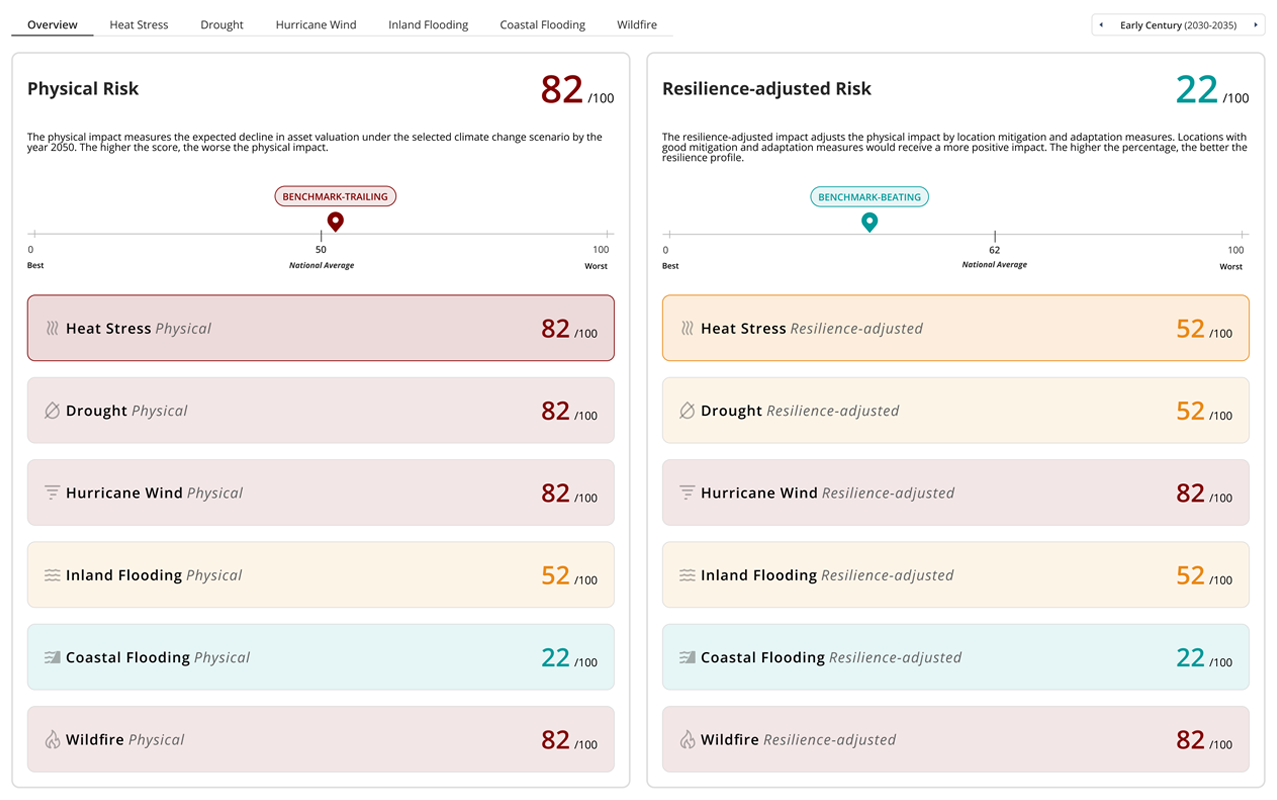

Integrate adaptation metrics for more accurate hazard impact modeling, and calibrate premiums based on client adaptation measures.

DATA PRODUCT

Climate Risk & Resilience Index

USE CASE

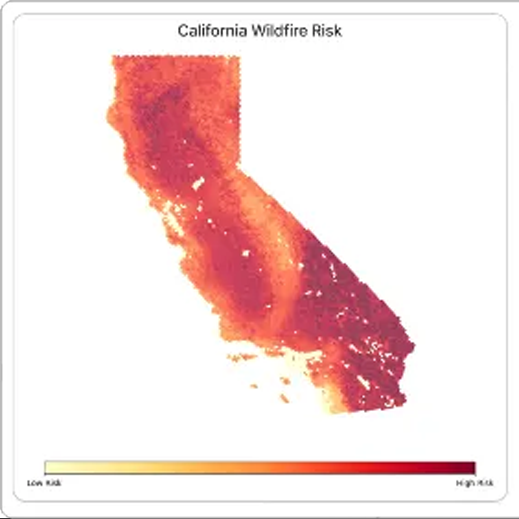

Risk modelling

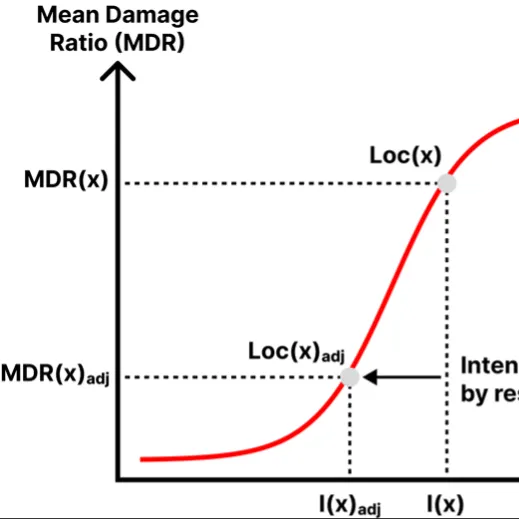

Integrate adaptation scoring into exposure and vulnerability analysis to accurately measure the resilience of client assets.

USE CASE

Underwriting

Calibrate premiums based on location adaptation capacity to climate hazards across multiple scenarios and time periods.

USE CASE

Adaptation strategies

Engage customers and stakeholders with recommendations and incentives to undertake adaptation measures that boost resilience.

Case studies

AlphaGeo is working together with Zurich Group Investment Management to optimize its Global Real Estate portfolio performance. Using AlphaGeo’s AI-powered analytics platform, the collaboration aims to enhance investment performance by identifying regions with higher growth prospects based on climate risk and social resilience, potentially leading to significant improvements in asset valuations.

FEATURED INSIGHTS