Location Strategies

AlphaGeo’s Location Strategies give clients first-mover advantage in identifying markets that best match strategic or investment objectives.

Our AI toolkit executes rigorous target market analysis, correlating industry and market data with our proprietary datasets for confident site selection and fund formation.

We help clients:

Identify locations in line with business strategy

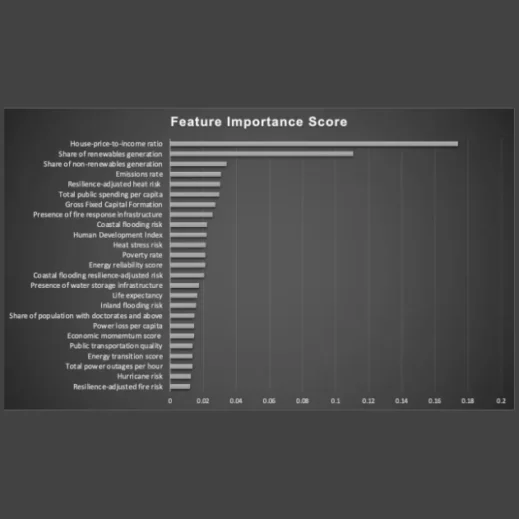

Filter, rank and identify prime locations based on a confluence of socioeconomic, commercial, demographic, climate, and other relevant factors.

Forecast land and asset values

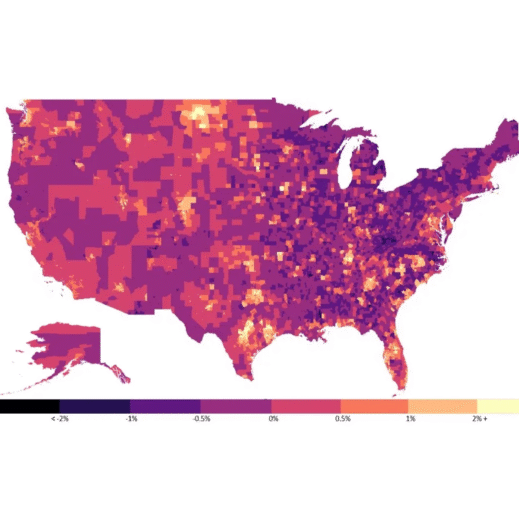

Leverage predictive analytics trained on traditional and alternative data to predict land and real estate prices.

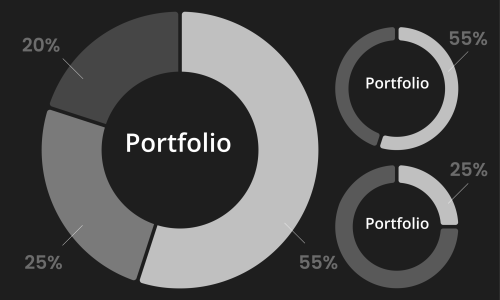

Construct real asset portfolios

Optimize portfolio construction across real estate, infrastructure, agriculture, nature-based solutions and other asset classes.

Certify resilient real estate

AlphaGeo’s Resilience Certification enhances the desirability of residential projects as well as brand credibility.

Serving:

Real estate developers, owners, and operators

Real asset investors (including real estate, land, infrastructure)

Corporates spanning industry, retail and other sectors

Case studies

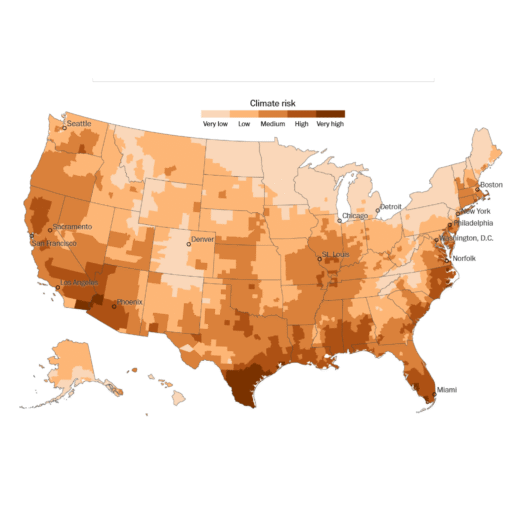

With climate awareness rising among homebuyers, one of America’s largest home builders sought to map out resilient locations for future housing starts. But it lacked robust data correlating land price forecasts to climate stability. In order to widen the footprint of its land banking strategy and anticipate the next set of fast-growing residential locations, AlphaGeo was used to identify the variables that will most influence liveability and property values. We analyzed both climate models and socio-economic trends, and ranked the counties where land was currently undervalued relative to their potential for appreciation. Our client was able to act on these arbitrage opportunities, deploying capital into geographies of high forecasted demand.

CapitaLand’s US investment team sought a comparative analysis of multiple high-growth cities for the industrial sector based on climate risk. CapitaLand commissioned AlphaGeo to produce a detailed study of scenarios for property valuations for a major commercial hub highlighting growth prospects for the industrial sector based on multiple climate, economic, and demographic trajectories.

Oaktree

Oaktree, a leader among global investment managers specializing in alternative investments, wanted to quantify its exposure to physical climate risk underneath its complex composition of real estate equity, private loans and traded securities. AlphaGeo worked closely with the firm to pinpoint climate risk, attribute it by fund, and calculate its potential impact over time. In analyzing the financial impact of climate volatility on its portfolios, Oaktree was able to rank and compare its asset performance across existing – and future – investments.

One of the largest US state pension systems with an actively managed global real estate portfolio contracted AlphaGeo to provide a risk and resilience assessment on each location of its portfolio of several hundred assets. Viewing this comprehensive analysis on AlphaGeo’s software interface allowed the team to benchmark property performance and future potential and adjust hold/sell periods accordingly. In the next phase, the transactions team leveraged AlphaGeo’s proprietary forecast of the fastest growing markets over the coming decade to priorities locations for upcoming acquisitions.

FEATURED INSIGHTS