INFRASTRUCTURE

Predictive location analytics for future-proof infrastructure

Enhance asset resilience through climate stress-tests and adaptation tools, as well as identify new markets for capital deployment.

DATA PRODUCT

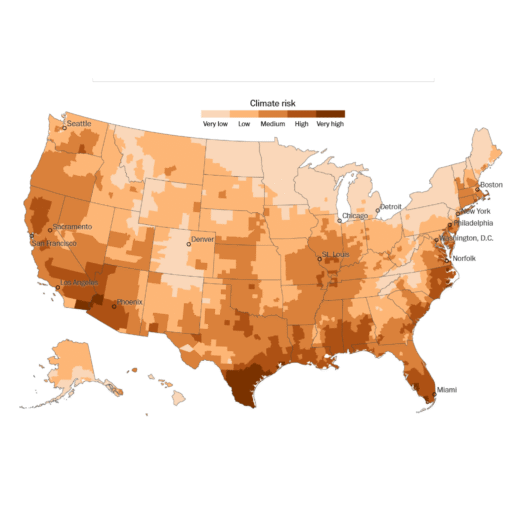

Climate Risk & Resilience Index

USE CASE

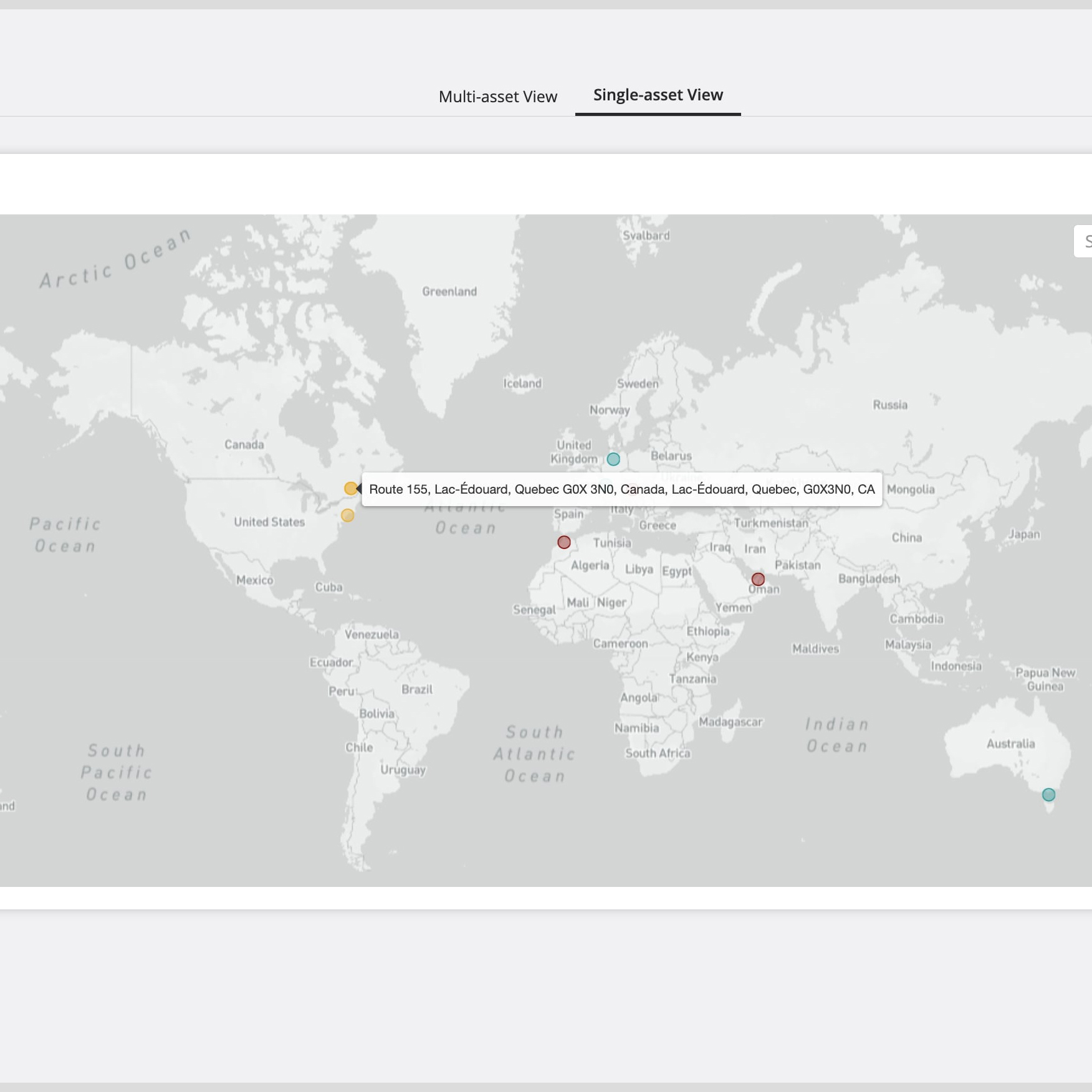

Market research and site selection

Screen and rank locations based on climate risk and resilience to validate and enhance investment strategy.

USE CASE

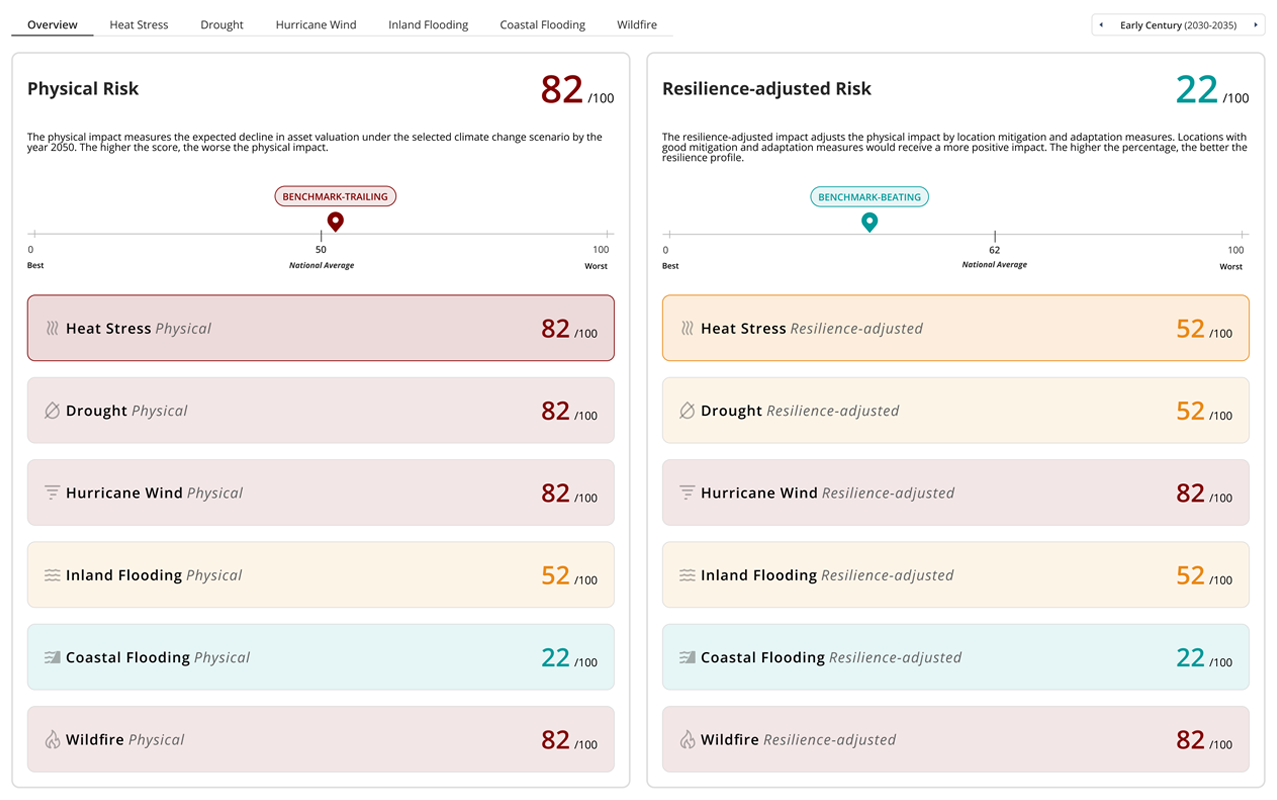

Risk and resilience assessment

Conduct multi-scenario, multi-timescale portfolio analysis at the asset or fund level, leveraging our on-demand reports for transparent and explainable reporting to investment committees and insurers.

USE CASE

Portfolio management and optimization

Use our Resilience-adjusted Risk Scores and Adaptation Layer data to identify adaptation gaps and remediation priorities, or adjust hold periods and disposition strategies.

USE CASE

Regulatory reporting and stakeholder engagement

Disclose climate physical risk exposures, assess impact of adaptation measures, and conduct climate-related scenario analyses in line with national and global regulatory standards.

USE CASE

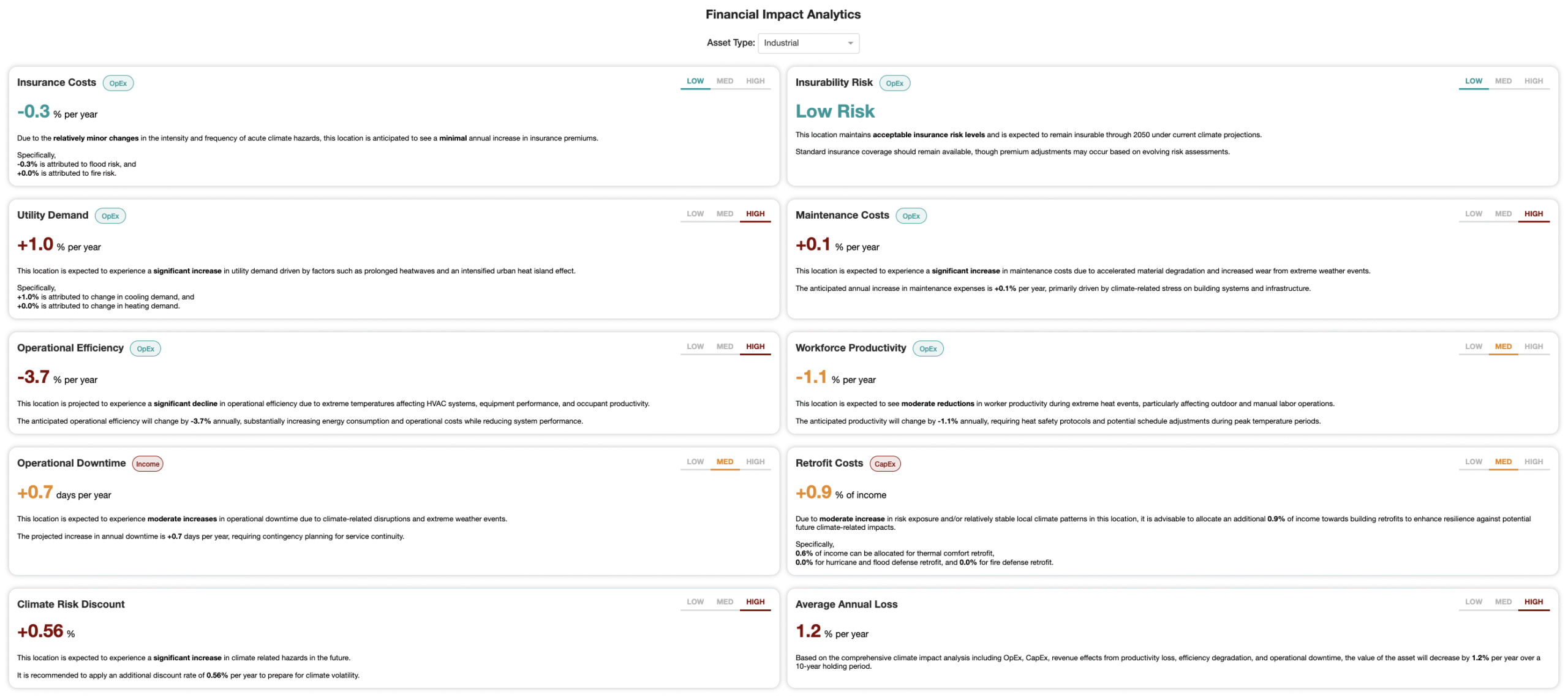

Financial and capital planning

Enhance budgeting and sensitivity analyses with our forecasts of key OpEx (i.e., insurance, utilities) and CapEx (retrofit) costs across multiple timescales and scenarios.

USE CASE

Valuation and investment strategy

Use our cashflow-based metrics and climate-adjusted discount rate for more robust, multi-scenario cashflow modeling, valuations, and returns analysis (e.g., DCF/NPV analysis).

USE CASE

Regulatory reporting and stakeholder engagement

Assess the impact of climate risks on financial performance for regulatory compliance and stakeholder reporting.

DATA PRODUCT

Financial Impact Analytics

Case studies

EQT, one of the world’s largest private equity firms, leverages AlphaGeo’s proprietary analytics to strengthen the resilience of its extensive and complex infrastructure portfolio. AlphaGeo’s data pinpoints zones of heightened climate risk, uncovers adaptation gaps, and quantifies the operational costs of climate volatility across tens of thousands of assets. It also highlights resilient markets and strategic locations for expansion, enabling EQT’s portfolio companies to optimize operations and capture new growth opportunities.

As climate change accelerates, data center operators face a dual imperative: scale to meet surging digital demand while embedding resilience and sustainability into every aspect of infrastructure planning. For Khazna Data Centers, the largest platform of hyperscale data centers in the region, this means aligning operational growth with its ESG commitments and the UAE’s Net Zero 2050 agenda. Khazna turned to AlphaGeo, an advanced climate intelligence tool, to translate environmental data into strategic foresight, enhance cross-functional decision-making, and future-proof its portfolio against both physical and systemic climate risks.

One of the largest Gulf sovereign wealth funds with a substantial global portfolio of infrastructure assets leveraged AlphaGeo’s platform to conduct a rigorous analysis of the medium term exposure to climate risk of its largest direct investments, including very large distributed infrastructures such as gas pipelines, railways and transmission grids. Sharing AlphaGeo’s data with relevant operating companies, it encouraged them to undertake more rigorous risk mitigation and local adaptation measures.

BayWa r.e. (https://www.baywa-re.com/en/), an Independent Power Producer (IPP) and global renewable energy developer of wind, solar and battery storage projects, sought a comprehensive analysis of the physical climate risk exposure of its portfolio of hundreds of projects worldwide. AlphaGeo applied both its Climate Risk and Resilience Index and Financial Impact Analytics to the BayWa r.e. project portfolio, providing a thorough outlook on each location that enabled their Sustainability team to measure the portfolio risk exposure systematically to meet different stakeholder expectations and focus on adaptation strategies for the high-risk assets.

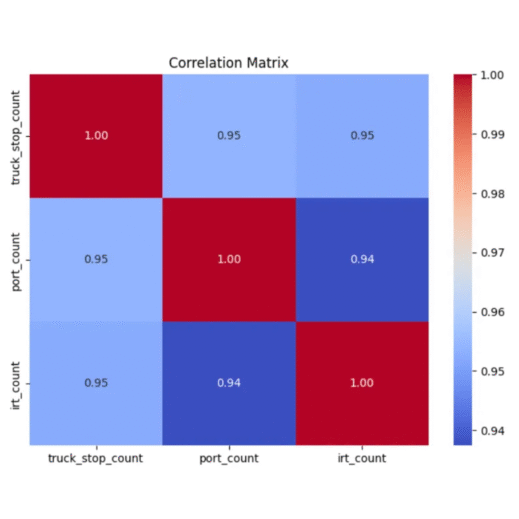

MARA (Nasdaq: MARA), the world leader in leveraging digital asset compute to support energy transformation, retained AlphaGeo to provide detailed data on the physical climate risk and adaptation attributes for every location of its data centers and other facilities, and leveraged its machine-learning models to forecast their energy costs and insurance premiums. AlphaGeo further offers its expertise to MARA and its financial partners and host governments to assess national energy supply and demand dynamics, address specific concerns such as water risk, and calculate power generation potential from existing and planned grid investments as well as renewable sources.

FEATURED INSIGHTS

Beyond VaR: Underwrite Climate Risk with Climate-Adjusted NPV

4 February, 2026

Power under pressure: Physical Climate Risk and Financial Impact for the Global Power Sector

6 November 2025

Introducing AlphaGeo’s Climate Financial Impact Analytics for Infrastructure

30 September 2025

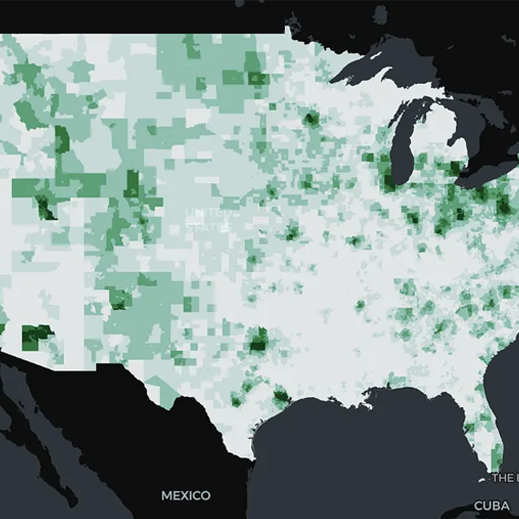

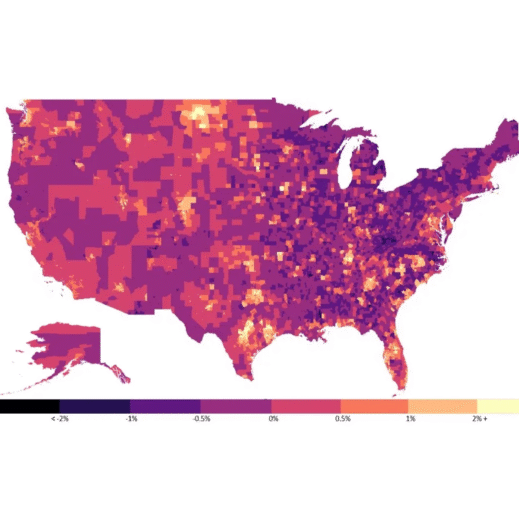

Pinpointing America’s New Industrial Hotspots with Data Science

26 July 2025

Decentralized Energy: How new distributed energy infrastructure will drive alpha generation in real estate investing.

June 2025

America’s Next Climate Migrations: In Search of Resilience

18 February 2025

Industrial Renaissance Tracker (IRT) Update: Insights into Investment and Logistic Clusters

29 January 2025

See if your city is poised to bounce back from the next climate disaster

20 November 2024