Real Estate

Predictive location analytics for future-proof real estate

Due diligence and risk assessments, property adaptation to climate hazards, and market research for acquisitions.

An end-to-end real estate solution

Geospatial Analytics

AI-powered data warehouse and custom software deploying globally downscaled datasets to support asset and portfolio level modeling for risk assessment, adaptation planning, market research, site selection and investment strategy across real assets.

Capital Formation

Deep client network and diverse capital ecosystem connecting GPs and LPs to structure funds, SPVs and land-banking and investment vehicles while driving fundraising and investor relations.

Asset Management

Extensive network (including land developers, home builders, property managers, financial and professional advisors, operational and technical partners, marketing and government relations) for project execution from design and construction to operations and maintenance.

Strategic Advisory

Foresight capability with global coverage spanning geopolitical, macroeconomic and regulatory variables informed by unmatched professional networks and cutting-edge AI-powered trend analysis to identify opportunities and inflection points.

DATA PRODUCT

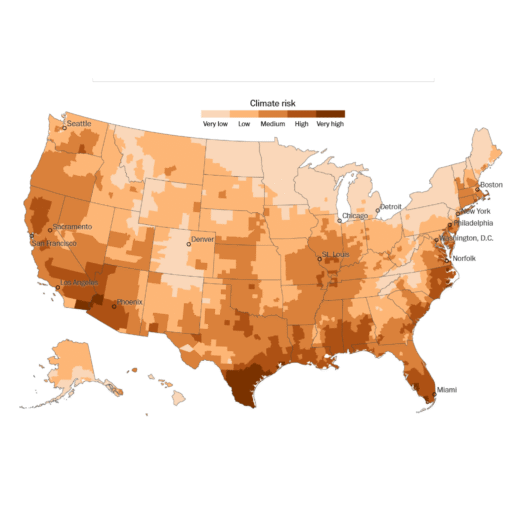

Climate Risk & Resilience Index

USE CASE

Market research and site selection

Use combination of climate risk scores, financial impact metrics, and location demand signals to screen and rank locations based on portfolio strategy.

USE CASE

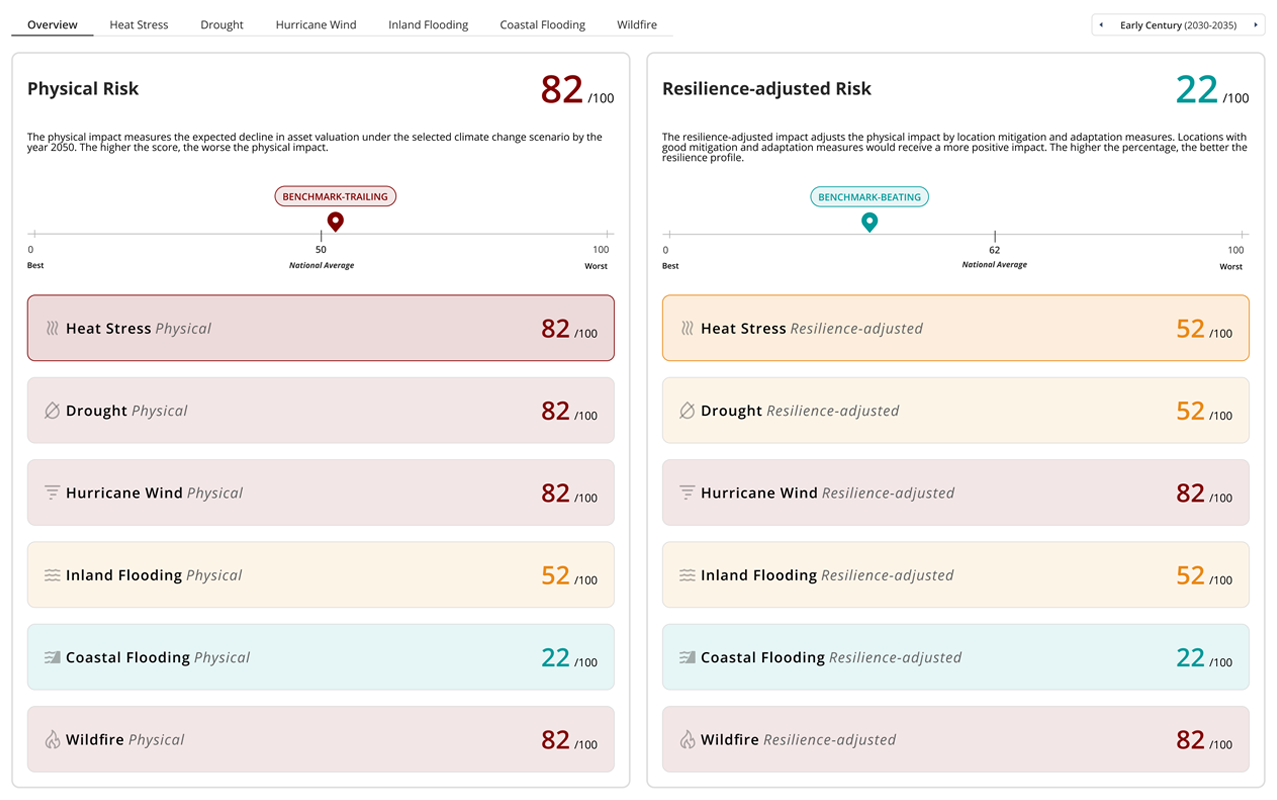

Risk and resilience assessment

Conduct multi-scenario, multi-timescale analysis of portfolio or asset-level risk and resilience, and download automated risk reports with transparent and explainable scores for senior stakeholders.

USE CASE

Portfolio management and optimization

Develop asset adaptation plans using underlying data on local adaptation capacity, and identify at-risk assets along multiple-timescales to plan disposition strategies.

USE CASE

Regulatory reporting and stakeholder engagement

Disclose climate physical risk exposures, assess impact of adaptation actions, and conduct climate-related scenario analyses in line with TCFD, IFRS S2, EU CSRD, and other standards.

USE CASE

Insurance assessment and negotiations

Determine if current adaptation measures on-site and in vicinity are sufficient to merit self-insurance or negotiate re-pricing with insurers.

USE CASE

Market research and site selection

Screen and rank locations based on degree of climate risk and resilience to assess location attractiveness in line with investment and/or business strategy.

USE CASE

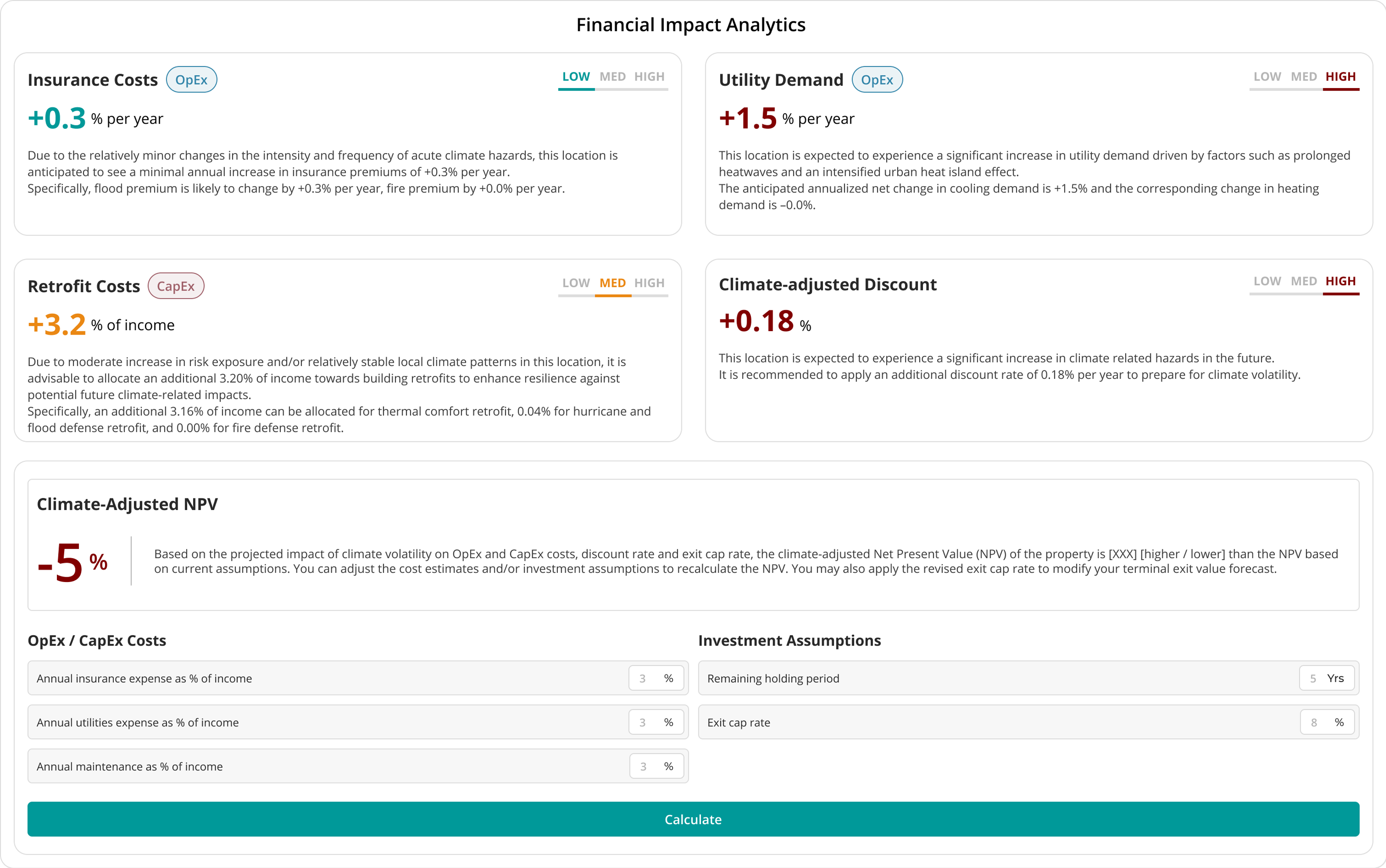

Valuation and investment decision-making

Integrate metrics into standard financial frameworks (e.g., DCF) to model changes in cashflows using our OpEx and CapEx metrics, and use our climate-adjusted discount rate for Net Present Value (NPV) analysis.

USE CASE

Financial and capital planning

Enhance forecasting of key OpEx components (i.e., insurance, utilities) and CapEx planning for potential retrofits.

USE CASE

Regulatory reporting and stakeholder engagement

Assess the impact of climate risks on financial position and planning, per requirements from TCFD, ISSB IFRS S2, EU CSRD, and others.

DATA PRODUCT

Financial Impact Analytics

Case studies

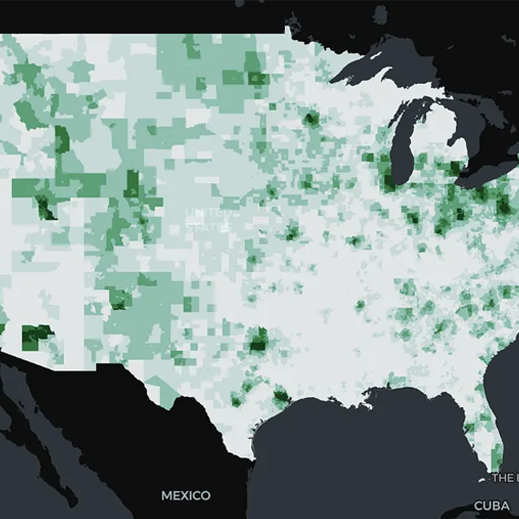

With climate awareness rising among homebuyers, one of America’s largest home builders sought to map out resilient locations for future housing starts. But it lacked robust data correlating land price forecasts to climate stability. In order to widen the footprint of its land banking strategy and anticipate the next set of fast-growing residential locations, AlphaGeo was used to identify the variables that will most influence liveability and property values. We analyzed both climate models and socio-economic trends, and ranked the counties where land was currently undervalued relative to their potential for appreciation. Our client was able to act on these arbitrage opportunities, deploying capital into geographies of high forecasted demand.

Oaktree

Oaktree, a leader among global investment managers specializing in alternative investments, wanted to quantify its exposure to physical climate risk underneath its complex composition of real estate equity, private loans and traded securities. AlphaGeo worked closely with the firm to pinpoint climate risk, attribute it by fund, and calculate its potential impact over time. In analyzing the financial impact of climate volatility on its portfolios, Oaktree was able to rank and compare its asset performance across existing – and future – investments.

CapitaLand’s US investment team sought a comparative analysis of multiple high-growth cities for the industrial sector based on climate risk. CapitaLand commissioned AlphaGeo to produce a detailed study of scenarios for property valuations for a major commercial hub highlighting growth prospects for the industrial sector based on multiple climate, economic, and demographic trajectories.

ACRE, a real estate investment company, collaborated with AlphaGeo to generate climate-driven valuations for a specific subset of its multi-family property funds. ACRE’s ESG investment team shared location data for key multi-family properties across the United States, and AlphaGeo utilized this data to provide Climate Price™ forecasts and Resilience Index™ scores. These forecasts and scores enabled ACRE to incorporate climate considerations into their valuation process, allowing them to assess the potential impact of climate change on their multi-family properties and make informed investment decisions.

Breevast took strong positions in distressed commercial properties in prime US cities after the 2008 financial crisis and sought to reassess its intended hold period in light of the Covid-19 pandemic. Breevast shared pertinent financial data related to the acquisition price and operational information such as occupancy and yield. AlphaGeo used these data points to refine the development of multiple valuation scenarios for each asset for Breevast’s investment committee to consider.

Baseline Property Group was undertaking a strategic expansion to build thousands of new holiday homes in fast-growing markets. AlphaGeo collected, assessed and layered a wide range of datasets related to holiday home rentals, building permitting, construction activity, recreational infrastructure, migration, economic activity, and the Resilience Index to identify locations best suited to Baseline’s mandate, as well as designed a sophisticated presentation for the firm’s management to share with its key external partners.

Reza Companies is a national retail investment advisory firm with a large footprint of retail and residential assets in key southwestern US cities sought a detailed market outlook for property values in light of growing climate change related risks. AlphaGeo conducted a granular assessment of climate scenarios for a range of adjacent zip codes in key metros areas and generated bespoke valuation forecasts for each of the client’s key 20 property locations.

FEATURED INSIGHTS

Climate Risks and Indian REITs: Mitigating Financial Impact

15 October 2025

Pinpointing America’s New Industrial Hotspots with Data Science

26 July 2025

Where Are America’s Most Dynamic Residential Markets?

19 July 2025

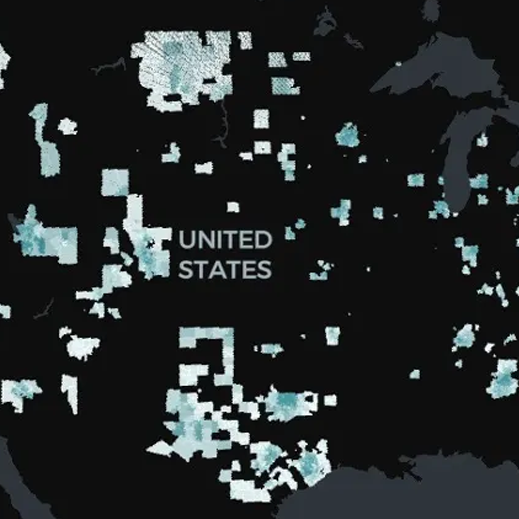

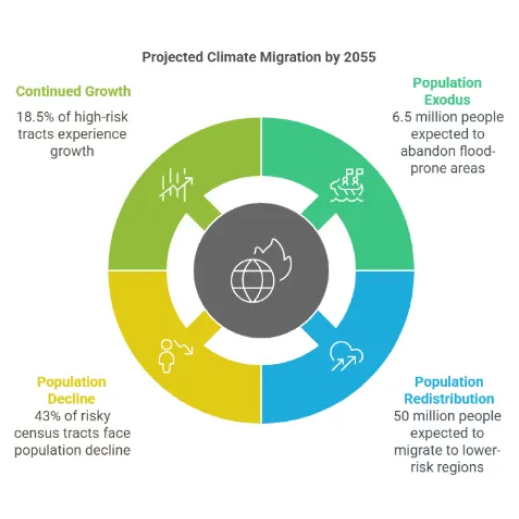

America’s Next Climate Migrations: In Search of Resilience

18 February 2025

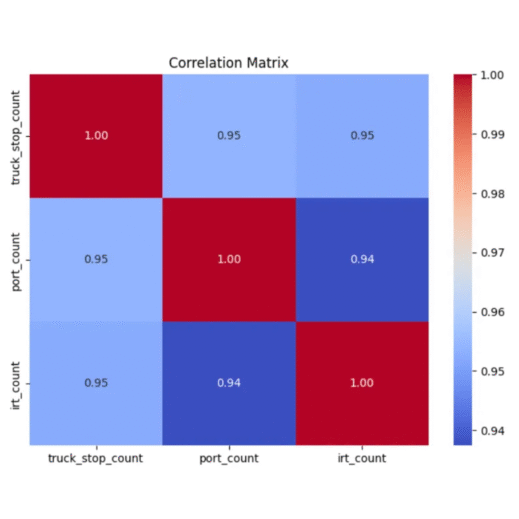

Industrial Renaissance Tracker (IRT) Update: Insights into Investment and Logistic Clusters

29 January 2025

What are the Top US Residential Markets for 2025–30 and Beyond?

5 October 2024