Climate adaptation has finally moved from the footnotes of climate reports into the core of risk management and investment strategy. Governments are publishing adaptation plans, supervisors are stress-testing bank liabilities for physical risk, and investors are asking a simple question: are their assets truly adapted for the climate volatility of the next decade?

BloombergNEF’s new Climate Adaptation Scorecard is an important milestone toward answering that question. By providing a dedicated national scorecard, Bloomberg signals that adaptation is now a material financial factor that warrants the same rigor as transition risk.

However, for investors making capital allocation and asset-level decisions, high-level sovereign benchmarking and policy-based scores are only the first part of the equation. To truly invest in adaptation — whether for infrastructure or real estate — investors need to bridge the gap between “national readiness” and “ground-truth resilience.”

The Two Lenses of Resilience: Policy vs. Ground Truth

What Bloomberg’s scorecard gets right

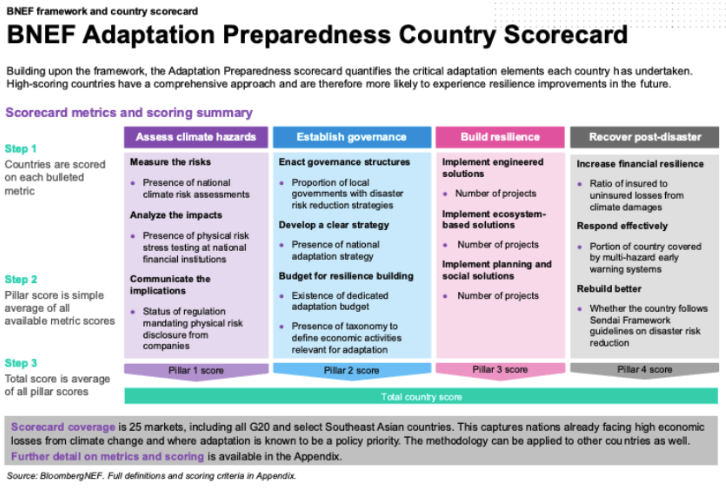

BloombergNEF’s framework provides a high-quality top-down view of how 25 major economies are adapting from a policy perspective.

The framework rests on 4 pillars:

- Assess climate hazards: Whether the country produces national climate risk assessments, whether supervisors run physical-risk stress tests, and whether firms are required to disclose physical risk.

- Establish governance: Share of local governments with a national adaptation strategy, share of local governments with disaster-risk-reduction plans, and whether there is a dedicated adaptation budget and taxonomy.

- Build resilience: Counts of engineered and ecosystem-based solutions, as well as the number of planning/social adaptation projects.

- Recover post-disaster: The ratio of insured to uninsured climate losses, coverage of multi-hazard early-warning systems, and adherence to the UN Sendai Framework.

For sovereign-level benchmarking and policy dialogue, this is an indispensable tool. It helps investors understand the regulatory and fiscal environment of a host country — a key determinant of systemic risk.

The Opportunity for Greater Granularity

However, while policy scores indicate intent, institutional investors managing physical assets often require a more granular, bottom-up perspective to answer tactical questions:

- Asset-level granularity: Policy scores that are national or sub-national cannot distinguish the resilience between 2 specific logistics hubs or office towers within the same city.

- Hazard-specific precision: Scoring the count of adaptation projects tells us little about whether these projects actually address the primary risks a location faces.

- Policy vs. reality: A country may have robust adaptation policy wording, but this alone does not tell us whether a specific exposed coastline actually has the defenses required to withstand a predicted high-probability storm surge.

- Global continuity: Investors with portfolios spanning global markets or specific regions outside the G20 need a consistent scoring methodology.

AlphaGeo: The Primary Intelligence Layer for Climate Adaptation

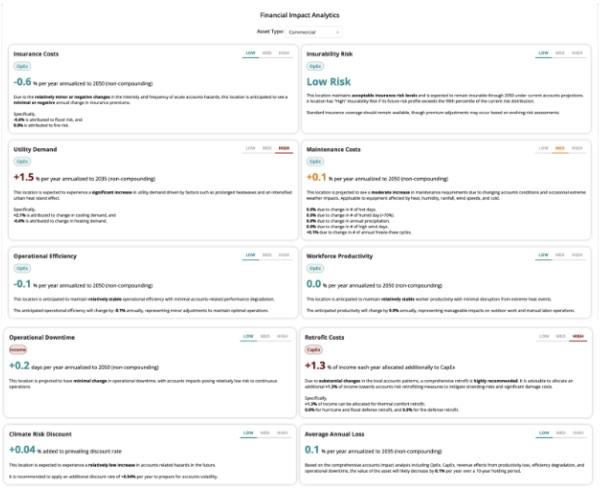

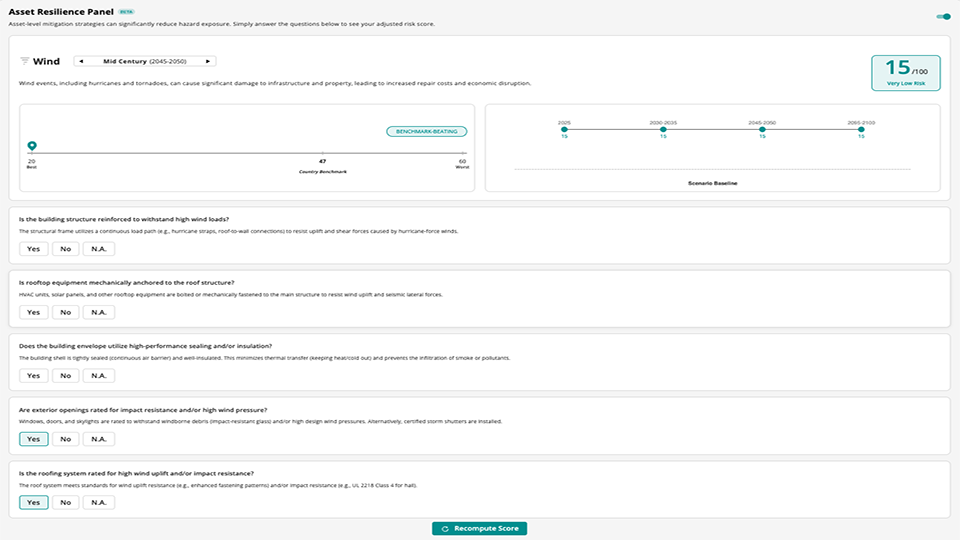

AlphaGeo bridges these gaps as investors’ primary intelligence layer for climate adaptation, providing the granular data necessary to turn a country-level scorecard into an actionable investment tool.

Our Global Adaptation Layer is a dataset of 20+ hazard-specific adaptation measures, providing:

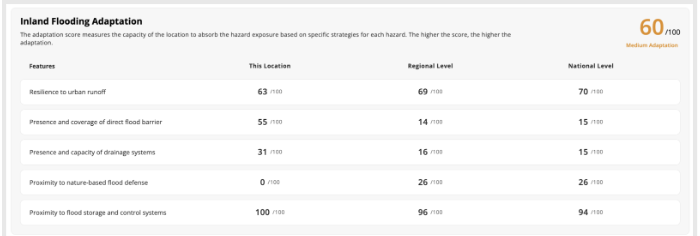

1. Ground-truth assessments via observed adaptation data (Figure 2): AlphaGeo uses advanced geospatial methods and satellite imagery to detect and quantify actual risk-mitigating infrastructure:

- Engineered defenses: We map defenses such as levees, seawalls, and drainage networks.

- Nature-based solutions: We measure measures such as urban greenery, surface porosity, and water storage capacity.

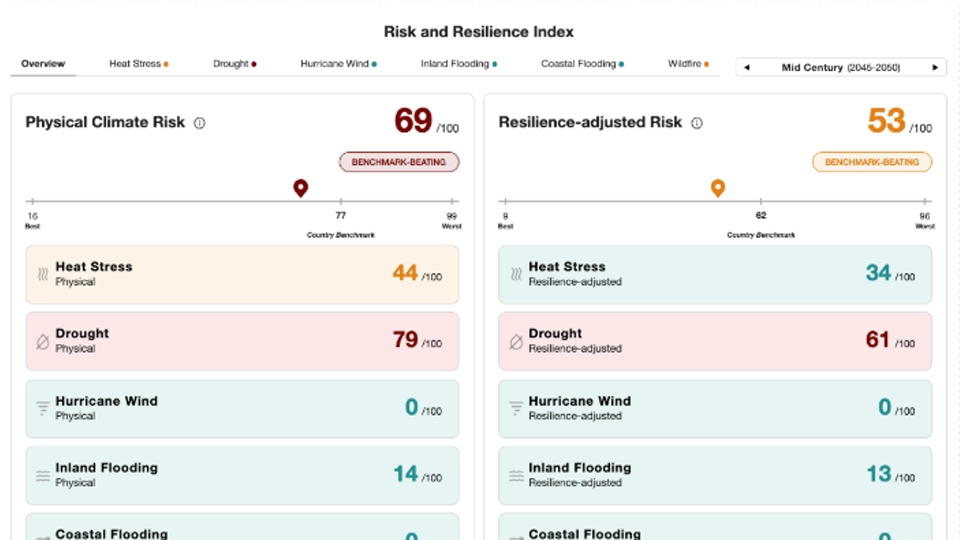

2. Hazard-specific adaptation scoring (Figure 2): Adaptation is not a monolith. A city might be well-prepared for heatwaves but highly vulnerable to inland flooding. AlphaGeo models multiple hazards separately, allowing investors to see exactly where adaptation gaps exist. This goes beyond policy intent or project counts to provide the “ground truth” answer to whether an asset is protected from its most critical hazard exposures.

3. Global, coordinate-level coverage: While traditional frameworks focus on major markets, AlphaGeo’s Climate Risk & Resilience Index is built to score any coordinate worldwide. We extend the lens of adaptation to any market, ensuring that investors have a consistent “resilience-adjusted” view across their entire global portfolio.

From national readiness to actionable decisions

The transition to a climate-resilient economy requires both top-down policy and bottom-up data. By layering policy-level insights with AlphaGeo’s asset-level, observed geospatial intelligence, investors can finally build a 360-degree view of climate risk and adaptation.