AlphaGeo was founded on the conviction that climate adaptation is as critical as mitigation — and investors are finally taking note. A recent GIC report, co-authored with Bain & Company, calls adaptation an “inevitable investment opportunity,” projecting the market to grow from US$2 trillion to US$9 trillion by 2050. Research from Jefferies further underscores its potential, noting that investors exposed to adaptation solutions stand to get total returns that are 13.5% higher than those on mitigation strategies. It is no wonder a slew of new adaptation funds has emerged in recent years, like Lightsmith’s Climate Resilience Partners.

To seize this opportunity, investors must navigate complex, localized climate risks and adaptation needs. Geospatial climate risk and adaptation data provides a powerful lens to identify high-potential markets, quantify demand, and uncover expansion whitespace. This article explores how private equity investors can leverage AlphaGeo’s geospatial data to drive strategic investment decisions in climate adaptation.

🛰️ The Role of Geospatial Data in Climate Adaptation

Climate adaptation is inherently location-specific, making geospatial data critical compared to other investment sectors. To assess market demand and opportunities, investors need geospatial data to:

1. Map Climate Risks: Risks are a prime driver of adaptation demand. Using datasets on hazards like flooding, heatwaves, or droughts is key when identifying areas with high demand for adaptation.

2. Assess Adaptation Capacity: If risks proxy demand, then existing adaptation capacity (e.g., presence flood barriers) reveals supply gaps.

3. Overlay Local Market Intelligence: Combining climate data with relevant market or socioeconomic factors helps prioritize those with strong tailwinds.

This data empowers investors to:

1. Generate investment themes: Identify high-potential markets or expansion opportunities

2. Model financials: Quantify demand and market size based on supply-demand gaps

3. Engage stakeholders: Measure the risk and adaptation impact of investments

💡 Illustrative Use Case: Identifying Markets for Flood-related Investments with AlphaGeo

This illustrative example demonstrates how AlphaGeo’s risk and adaptation data can be used to help identify high-potential markets for flood-related solutions.

1) Map “resilience-adjusted” flood risks — i.e., areas that are high-risk, yet poorly adapted

First, analysts can tap into AlphaGeo’s Resilience-adjusted Risk scores (part of our Global Risk and Resilience Index) to identify areas that have high flood risk, but insufficient adaptive capacity. This pinpoints markets where demand for flood defenses is expected to grow.

2) Assess adaptation capacity:

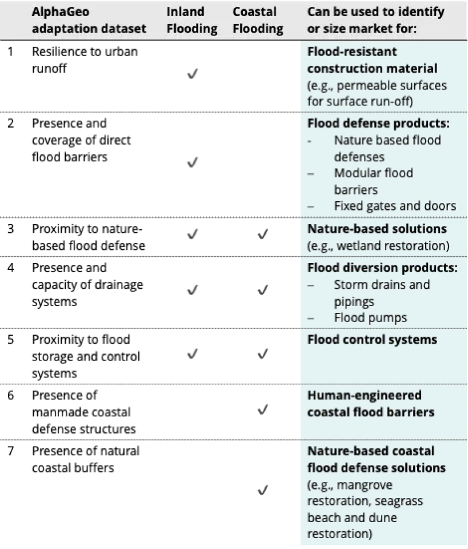

Next, analysts can use our Global Adaptation Layer dataset that covers measures for six hazards, including inland and coastal flooding. This dataset helps investors pinpoint gaps in hazard-specific measures (e.g., drainage systems or nature-based barriers), to identify and size the market for high-demand adaptation products or services. Our datasets cover measures that are both human-engineered or nature-based, proving equally useful for the many emerging players who are investing in nature-based solutions.

Table 1 below summarizes AlphaGeo’s flood-related adaptation dataset, showing how it can size markets for specific solutions, including both engineered and nature-based approaches.

🔚 Conclusion

As climate change intensifies, climate adaptation will become both an inevitable need as well as a significant investment opportunity. Because adaptation requires an understanding of localized environmental risks and gaps, investors who successfully integrate geospatial risk and adaptation data into more traditional analytical processes will have a competitive advantage. By mapping risks, identifying high-potential markets, and quantifying impact, this data enables investors to uncover untapped opportunities and build portfolios that deliver both financial returns and societal value.