Introduction

Climate risk is no longer just an ESG concern. As climate change increasingly affects core financial drivers, investment teams, corporate strategists, and financial planners alike are recognizing the need for climate-informed modeling. Yet many still lack the tools to connect climate risks to financial outcomes.

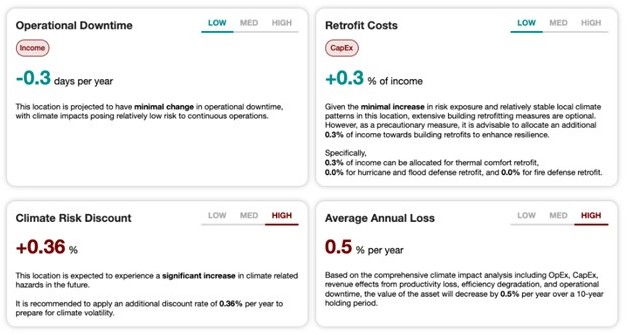

To bridge this gap, AlphaGeo’s Climate Finance 101 series demystifies how climate risks translate into financial impact. In this installment, we explore how climate change impacts operational downtime, in turn affecting operational costs and income — and explain our approach to modeling this through our Operational Downtime Impact metric.

How Climate Change Affects Operational Downtime

We forecast the combined change in the following factors, as a proxy for the projected change in operational downtime: (1) heavy precipitation days; (2) fire impact days; (3) dry spell days; and (4) hot days. These are the climate variables we have identified as those most likely to cause a temporary slowdown or complete shutdown of operations.

Climate hazards can cause critical infrastructure disruptions through:

- Change in the number of heavy precipitation days, or days/year with precipitation above historic 95th percentile. Extreme rainfall can cause localized flooding, disrupting logistics, access, and site safety.

- Change in our fire impact score, which models financial risk from fire. A higher score reflects an increased likelihood of severe fire events necessitating halts in operations.

- Change in the number of dry spell days (14+days with <1mm rain), as extended dry spells can lead to water use restrictions or shortages, impacting operations.

- Change in the number of annual hot days (>40 degree celsius), as extreme heat can force facilities past their operational or regulatory thresholds.

How AlphaGeo Models Climate Impact on Operational Downtime

We forecast the combined change in the following factors, as a proxy for the projected change in operational downtime: (1) heavy precipitation days; (2) fire impact days; (3) dry spell days. These are the climate variables we have identified as those most likely to cause a temporary slowdown or complete shutdown of operations.

- Change in the number of heavy precipitation days, or days/year with precipitation above historic 95th percentile. Extreme rainfall can cause localized flooding, disrupting logistics, access, and site safety.

- Change in our fire impact score, which models financial risk from fire. A higher score reflects an increased likelihood of severe fire events necessitating halts in operations.

- Change in the number of dry spell days (14+days with <1mm rain), as extended dry spells can lead to water use restrictions or shortages, impacting operations.

Why This Matters

Understanding how climate change affects operational downtime is key to:

- Robust financial modelling and planning: Operational downtime results in lost revenues and rising costs, which can cause an unexpected hit to cash flow and projected valuations.

- Adaptation and business continuity planning: Organizations that understand how operations are set to be affected by climate change can plan proactively for adaptation.

Learn More

- Insights and Research: Follow us on LinkedIn or Medium to stay updated on our Climate Finance 101 series and other insights.

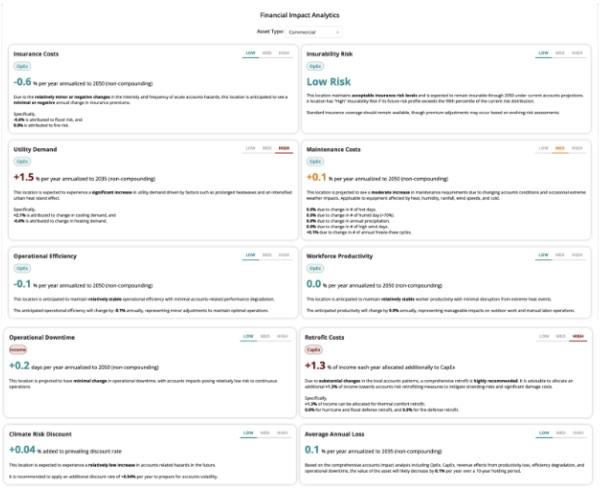

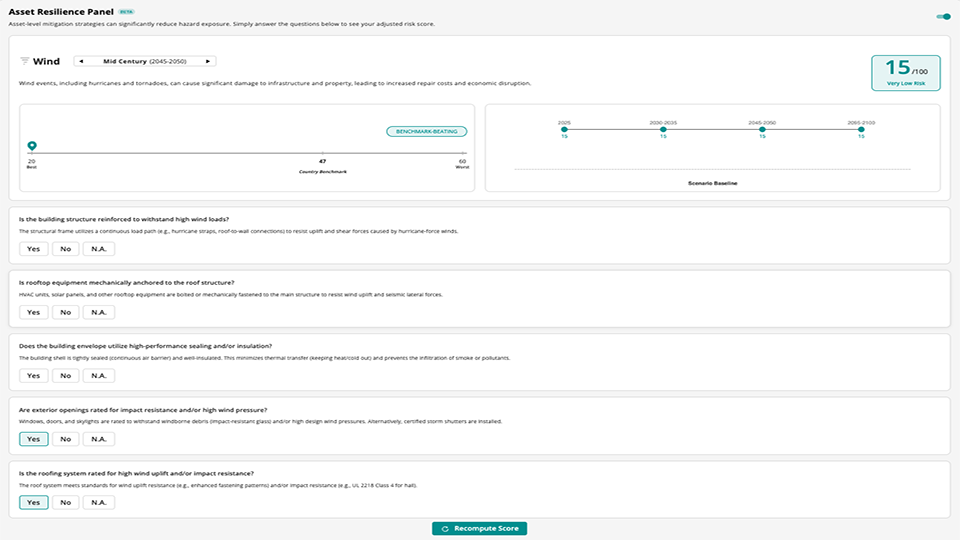

- Financial Impact Analytics: Discover how our Financial Impact Analytics suite translates climate risk into financial impact. Learn more here.

- Other Solutions: Visit alphageo.ai to learn more about us or contact us at [email protected] to schedule a call.

- Access Free Trial: Explore our platform today at app.alphageo.ai/trial_setup